Five fund managers give their best investment ideas

21st September 2017 17:26

by Marina Gerner from interactive investor

Share on

This month we catch up once again with our panel of multi-managers and ask for their views on the best investments opportunities.

Rather than build their portfolios by investing in individual stocks or bonds, our experts invest largely or exclusively in investment funds and trusts, which leaves them well-placed to identify the strongest prospects.

Considering the uncertainty around the Brexit negotiations and Donald Trump's policies, some of our managers opt for a more cautious approach.

Several are looking towards Asia, especially Japan, to escape the nervousness surrounding politics in the West.

However, others opt for UK- and Europe-focused funds, arguing that opportunities are still to be had in certain sectors across those regions, such as student accommodation in the UK.

Meanwhile, some of our panellists express an interest in the technology sector and the gold sector, to further diversify and mitigate against prevailing political and geopolitical uncertainties. As ever, diversification remains paramount to all of them.

Peter Hewitt - F&C

The biotechnology and healthcare sector possesses certain attractive long-term secular growth characteristics, argues Hewitt; but over the past year concerns over the outlook for drug pricing in the US has caused uncertainty among investors, and as a result shares in investment companies specialising in this area have come under pressure.

However, Hewitt says: "The industry fundamentals remain positive, with a series of new products, particularly in the field of gene therapy, likely soon."

In addition, there is continuing M&A activity as big pharma firms seek to redeploy their cash flows into purchasing biotech companies with exciting new products.

"In my opinion, valuations are at highly attractive levels, with the sector rated more cheaply than mainstream US equities yet with stronger earnings growth. An excellent way to gain exposure to these characteristics is through the ," he comments. It is valued at £1.2 billion and trades around asset value.

Another area of interest for Hewitt is Japan, which he says "appears to have been very much under the radar in recent months". Although the macro case for Japan is not exciting, what is changing is the corporate culture, which is becoming much more shareholder friendly.

Further, the level of innovation among smaller and medium-sized companies in Japan remains world-leading. " is focused on growth companies in this area of the market, and has built an outstanding long-term record," Hewitt notes.

Uncertainty in the UK economy and markets is high, he adds. "Against this backdrop, UK smaller companies could be described as an out of favour sector, but the has consistently outperformed, driven by good stock selection."

He points out that for a long-term investor the 15% discount (as at 11 August) could be a good entry point.

Ayesha Akbar - Fidelity

Investors have experienced a reasonably benign environment since early 2016, with risk assets performing strongly. But Akbar argues these conditions are unlikely to last forever, and that building in a bit more protection into your portfolio might be sensible.

Her first pick is the . Run by Stephanie Butcher, it aims to generate a rising level of income, together with long-term capital growth.

"Equity income funds tend to be concentrated in traditional dividend-paying sectors," says Akbar. "Stephanie, however, does not have any preconceived notions about where income stocks can be found, and the fund often invests in unloved, undervalued parts of the market."

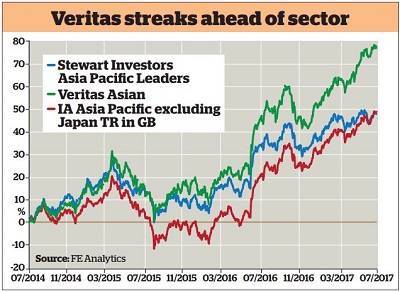

Her second choice is . The fund is managed by David Gait and Sashi Reddy, who run a portfolio of 30 to 70 stocks.

"The managers take a conservative approach to selecting stocks, only choosing companies that can benefit from sustainable development - both economically and environmentally," says Akbar.

"Stocks are split into three broad buckets: those that produce sustainable goods such as vaccines, providers of responsible finance, and companies delivering infrastructure that society needs to function."

The fund favours low-risk and high-quality stocks, according to Akbar, which makes it a conservative choice for investors who are nervous about higher market volatility.

Building on this conservative approach, her final choice is . It invests in companies that mine and produce precious metals. As the name suggests, the fund's main exposure is to gold, which tends to operate as a 'safe-haven' choice when equity markets fall.

David Coombs - Rathbones

In China, the number of technology firms, insurers and other firms catering for consumers is growing quickly.

"We have invested in the East for many years, sometimes through shares in companies and other times using funds such as ," says Coombs.

"The sheer number of people who have worked hard and broken into the middle classes in developing nations is driving extraordinary growth in industries that offer much higher value than knock-off sneakers, plastic toys and tonnes of steel."

But rapid innovation brings risks too, especially when there is less support for free trade, and Coombs warns that "investing in markets with weaker investor protections means this is not for the faint-hearted".

Another of his picks, the Coupland Cardiff Japan Alpha fund, offers something different entirely.

He owns this fund because he believes "seismic changes are happening in Japanese business culture".

For decades, Japan's conglomerates were run for the benefit of employees. Shareholders generally saw poor returns and had little sway in boardrooms, but prime minister Shinzo Abe's reforms are changing that.

"Share buybacks and dividend payments have soared in the last couple of years," says Coombs.

His third choice is the Brown US Small Cap Blendfund, which "should be well placed to benefit from a strong US domestic market".

This fund invests in companies with small market capitalisations (though they are still billion-dollar companies).

The portfolio is split in two, with half invested in line with Brown's value strategy and half following its growth strategy.

He says: "US share markets are highly sensitive to shifts in investor preference for growth or value companies. We feel splitting our exposure this way helps to mitigate this risk in our portfolios."

Coombs adds that while Donald Trump is having little success with his legislative agenda, this hasn't prevented small business confidence riding at high levels.

David Hambidge - Premier Asset Management

Given the elevated level of stockmarkets, Hambidge's first pick this month is "more about capital preservation and anyone looking to get rich quick will be disappointed".

He says the has so far delivered attractive levels of income compared with prevailing interest rates, with a strong focus on capital preservation.

"The fund invests in a diversified portfolio of good quality European and Australian asset-backed securities with a bias towards residential and commercial property," he explains.

Hambidge's second pick is 'more mainstream' and, like TwentyFour Monument Bond, is a fund that the team has held for many years within its multi-asset portfolios.

The invests primarily in UK equities that can deliver high returns on capital and sustainable real dividend growth.

The majority of the portfolio is in large and medium sized companies, and the fund also generates a healthy income, currently just over 3%.

Following a challenging period after the Brexit vote last summer, UK commercial property values enjoyed a strong first half of 2017, and Hambidge says he has recently been taking profits in some of his property holdings.

However, he recently added , which invests in modern student accommodation, primarily in London.

"Demand for quality accommodation in this sector continues to significantly outweigh supply; with the shares currently yielding around 4% and having some inflation protection, we believe that returns going forward should be attractive."

Peter Walls - Unicorn Mastertrust

Under the strong government of Narendra Modi, significant reforms are taking place in India, where the economy is likely to be among the fastest-growing in the world over the next decade and beyond, argues Walls.

"Demonetisation appears to have been a success and new bank accounts have been opened at a rate of 100 million in each of the past two years. With one billion of the population now holding unique IDs, the adoption of new technology is expected to transform the economy."

He says the fund looks interesting and trades at a generous discount despite delivering strong performance in recent years.

His second choice is the which, he says, should be a beneficiary of rising interest rates.

"It has the additional attraction of a fixed life, which will lead to the elimination of its discount between now and May 2020."

Walls' final pick is , managed by James Henderson.

He says: "It is one of a kind in the investment trust sector as it offers exposure to a subsidiary independent fiduciary services business and a managed global equity portfolio."

He adds the trust offers a dividend yield of around 3%, and is "one of the most conservatively run funds in the market".

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.