Income investment trusts which deliver cash cow yields

4th October 2017 09:33

by Holly Black from interactive investor

Share on

In the few months since we last looked at our closed-ended Regular Income portfolio, we have had a general election, the establishment of a hung parliament, terrorist attacks and a rise in tensions between the US and North Korea. "If you had told me back in April, with so many challenges on the horizon, that we would produce this performance, I would have thought you were mad," says investment trust specialist James Brumwell, who manages the portfolio.

In fact, with so much geopolitical and economic uncertainty, investors have been loyally sticking to their steady, income-focused investments and that has been a major boon to this portfolio. Buoyed by his success so far, Brumwell too is sticking with his choices and there are no changes to this portfolio at its first review. It is currently yielding 4.13%, marginally down from 4.2% at inception due to the strength of capital growth over recent months.

Just one of the 15 investment trust constituents is in the red after five months, and other holdings have produced some stellar returns over the short period. Chief among those is , which has returned an incredible 17.9% since the portfolio's inception. While the trust doesn't produce much in the way of yield (currently 1.7%), it was included in the portfolio for its long-term proven track record of delivering reliable returns whatever the weather.

In recent months, the fact that 42% of the trust's assets are in popular US companies such as internet retailer and electric car maker has helped to drive forward returns. Its second-largest weighting is to China, which has rallied recently as fears of an economic slowdown and rising debt have eased off.

Brumwell says: "Scottish Mortgage is just a very good investment, I've owned it for donkey's years, but it probably won't do this every quarter. Perhaps if it keeps rising at this rate we might take some profits, but I don't like to do that for small amounts because the cost of trading negates the profit you've made."

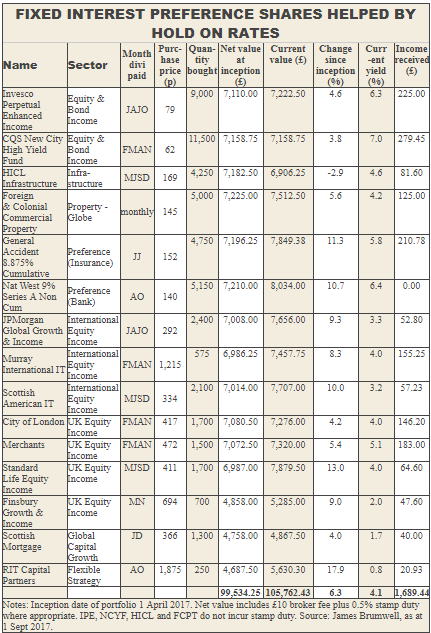

Preference shares up

Among the other top performers are , which has returned just shy of 13%, and the two sets of preference shares, from and National Westminster, which are up 11.3% and 10.7% respectively. Brumwell says these latter two have benefited as the UK looks less likely to raise interest rates this year. Fixed interest investments could find themselves under pressure if rates rise, as their returns become less appealing, but with a rate hike looking less probable, they are retaining their allure.

While the General Accident shares, which yield 5.8%, have already earned the portfolio £210.78 in income, investors will have to wait until October for their first payout from the NatWest holding. This yields a meaty 6.4% and is the only constituent of the portfolio yet to pay out.

Meanwhile, the UK-focused Standard Life fund has been boosted by its investments in companies with overseas earnings, such as and , which have been given a lift by the weak pound.

What Brumwell calls the one "fly in the ointment" is , which has fallen back slightly after funding rounds over the summer. He says: "This is just the business model of that trust - it bids for things, wins and then raises the money to pay for them. But I'm not worried as the last couple of rounds have been oversubscribed, so the demand is there."

In July HICL acquired a 35% stake in the High Speed 1 rail project, so there is every likelihood it could return to shareholders for another round of funding in the near future too, which could further dent its performance. But Brumwell is not concerned about that while the trust is still yielding an attractive 4.55%.

Highest yielder

The highest yielder in the portfolio is the at just over 7%. It's a complicated vehicle, investing in a mix of preference shares, loan stocks and corporate bonds, but has already brought in £279.45 in income.

Meanwhile, our international equity investments have all delivered strong total returns. With investments spanning the US, Australia, China and Brazil, the is up 10% since portfolio launch and producing a respectable 3.2% yield. , whose largest country weightings include Mexico, Taiwan and Indonesia, yields slightly more at 4% and is up slightly less at 8.3%.

Overall, it's been an auspicious start for the Regular Income portfolio, which has already bagged £1,689 in income. Brumwell says: "Investors who had stuck to the old investment adage that you should sell in May would have missed a decent rally this year. It is slightly surprising the whole portfolio is up, especially over the summer which usually tends to be more placid."

Like many other investors at the moment, Brumwell is concerned that global stockmarkets are in bubble territory. Investors seem complacent and any market corrections are quickly reversed. But, he argues, it makes sense to be in the market and to enjoy the gains while they are still there to be made, rather than move to cash out of fear and potentially miss out.

Over the coming months Brumwell will be keeping an eye on exchange rates and the likelihood of interest rate raises, to determine whether our next review will bring any changes. He says: "While there are reasons that performance has been so strong, such as the weakness of the pound, it's certainly a nice problem to have. I guess the only issue is that you could argue that if all of the holdings can go up together, they can fall together too."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.