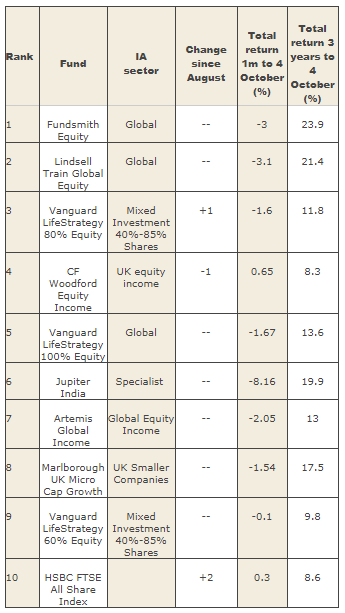

10 most popular funds - September 2017

10th October 2017 12:01

by Marina Gerner from interactive investor

Share on

Neil Woodford has slipped out of the top three in our most-bought funds league table. Money Observer Rated Fund took the top position once again in our list of the most-bought funds on Interactive Investor this September.

The fund is managed by the highly regarded investor Terry Smith. It has over half of its assets in US equities, and 19% in UK equities, with top holdings including , and . Seven of the ten most-bought funds remain unchanged from August.

Money Observer Rated Fund kept its second placed position. Jointly managed by Michael Lindsell and Nick Train, the fund has returned 10.3% over six months and 15% over one year.

- Invest with ii: Top Investment Funds | Index Tracker Funds | FTSE Tracker Funds

The third place in the list was taken by passive fund , which focuses on US, UK and European equities, as well as global bonds.

It overtook Neil Woodford's eponymous open-ended fund, , which dropped one spot to take fourth place in September. The fund has lost 3.9% over the last three months. Woodford has issued an apology and explanation for his recent poor performance.

Fifth spot was taken by another passive fund, , which has gained 4.2% over six months.

It was closely followed by Jupiter India, which shed 3% over the last six months but has gained 77.6% over the last three years. The country's ongoing tax reforms are seen as a positive development for the dynamic Indian economy, despite progressing at a slow pace.

was the seventh most-bought fund in September, during which time it shed 2%. It has a third of its money in US equities, much lower than the typical global fund.

According to Morningstar global funds have on average 47% of their assets in US shares - more or less in line with the MSCI World Index (53% in the US), a benchmark many funds in the sector pitch themselves against.

Its five year track record puts the fund in number one position in its sector, but the low weighting to the US has held back performance over the past six months.

Artemis Global Income has returned 1.6%, while the Investment Association Global Equity Income sector average is showing a gain of 3.3%.

Brian Dennehy of Fund Expert notes: "Growth has come from big tech companies in the US, which the manager cannot hold as they don't pay dividends. Given the strong run these already expensive stocks have enjoyed, the manager is cautious on the outlook for the remainder of 2017."

Artemis Global Income was closely followed by Marlborough UK Micro Cap Growth, which took eighth place in September, and has returned 8% over the last three months. It is predominantly invested in UK smaller companies, with 24% of its holdings in industrials and 21% in the technology sector.

Meanwhile, passive fund , which has 26% in US equities, 19% in global bonds, and 15% in UK equities, took ninth spot.

And finally, the tenth spot was taken by HSBC FTSE All Share, which went up two spots to tenth place. It is worth pointing out that four of the top 10 most-bought funds were passive ones, in keeping with a continuing wider trend to opt for low-cost tracker funds.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.