Nine 'safe haven' investment trusts to weather a market slide

26th October 2017 09:27

by Fiona Hamilton from interactive investor

Share on

With the eight-year rally in world stockmarkets starting to stutter, those keen to shelter part of their portfolio should consider the flexible investment trust sector.

Whereas trusts in other sectors are expected to keep most of their portfolios in specified categories - such as equities, bonds, property, private equity, infrastructure, renewables, mining, forestry, aircraft leasing, insurance or utilities-flexible investment trusts are free to invest in any of those asset classes and others, mixing, matching and switching between them as their managers see fit.

Although most focus on achieving consistently positive returns, rather than outperforming an index, they are an exceptionally mixed bunch, so investors need to choose carefully.

On the defensive

The most defensively positioned are , and the tiny .

All three have relatively straightforward portfolios, with between 21 and 43% in quoted equities and between 25 and 62% in top-quality fixed-income securities. Capital Gearing has 14% in property and a little in private equity, while Personal Assets has around a third of its funds in cash or gold.

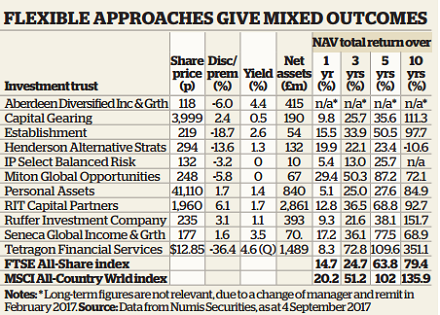

The net asset value (NAV) total returns of all three trusts have significantly lagged the over the past one and five years, and fallen even further behind the MSCI All-Country World index, but that has not unduly worried the trusts' boards and managers. Nor has it undermined the trusts' appeal to investors, who understand that their overriding priority is wealth conservation in real terms.

With managers of flexible trusts convinced that most equities and bonds are dangerously highly valued, that the financial system has never really recovered from the 2008 crisis, and that geopolitical tensions could trigger a severe setback, they have been increasingly cautiously positioned.

They have undeniably missed out on a lot of money-making opportunities in recent years, but they hope to more than compensate by holding up exceptionally well when the downturn comes and then deploying the cash available for bargain-hunting after the fall.

If this happens, history will be repeating itself, as Capital Gearing and Personal Assets both proved particularly resilient during the 2007/09 crash. As a result, their 10-year NAV total returns remain well ahead of the FTSE All-Share index and many of their more adventurously managed peers.

What is more, Capital Gearing's NAV per share has risen in each of the past 20 financial years, bar small setbacks in the 12 months to March 2009 and 2014, while Personal Assets and the IP Select trust have also shown reassuringly low volatility. To further protect investors from swings in market sentiment, all three trusts have zero discount policies.

is similar to Personal Assets and Capital Gearing in that it puts a high priority on capital preservation, seeks consistently positive annual results after all expenses and focuses almost entirely on assets that investors can easily understand.

These include high-quality sovereign bonds, UK and overseas equities and gold. Its managers, Hamish Baillie and Steve Russell, believe investors are far too complacent about the outlook, and they doubt that economic growth "will be sufficient to support current valuations or pay down debts accrued in the global economy".

However, they admit their caution could prove premature, so nearly half their portfolio remains invested in Japanese, UK and US equities, with the emphasis on banks and other firms geared into improving economic activity should the 'inevitable inflection point' prove some way off.

Ruffer achieved impressively consistent gains in its first eight years, including a remarkable 27 % NAV total return in 2008, when most globally diversified trusts were deeply in the red.

However, it has been less surefooted since Jonathan Ruffer handed over day to-day charge in 2012, and its five-year returns are disappointing, given its attempts to pursue a balanced approach.

Value added

also makes capital preservation a priority. Founder and chairman Lord Rothschild believes most stockmarkets are very expensive relative to growth prospects, so the sector giant has frequently had less than half its assets in quoted equities in recent years.

However, the trust's management team, led by Francesco Goedhuis, has deployed a growing range of strategies to add value, including a credit portfolio and a currency overlay. The latter added nearly 10% to RIT Capital Partners' NAV total return last year, but it proved a drag in the first half of 2017,due to sterling's recovery against the dollar.

RIT Capital Partners has been a bit more volatile than the other trusts mentioned so far; it suffered a bigger set back in 2008 and it could prove more vulnerable in the next downturn.

But the quid pro quo is that its NAV total return has outperformed the FTSE All-Share index over three and five years.

Encouragingly, its managers remain open to new ideas, as shown by their recent decision to partner with a leading Silicon Valley firm in order to "enhance [the trust's] ability to assess investment opportunities arising from the innovation-driven changes affecting most business sectors."

Lord Rothschild claims that since inception in 1988, RIT Capital Partners has participated in 75% of market upside but only 39% of market declines, and that over that period shareholder returns have compounded at almost twice the rate of returns on the MSCI All-Country World index.

Disappointingly, though, it has underperformed that index over the past 10 years.

Tetragon Financial Group's returns look outstanding and it pays an attractive yield, but it trades at a massive discount.

Specialist brokers are steering clear, due to worries over corporate governance. Its portfolio is hard to value, its fees are high and its dollar-quoted shares have no voting rights.

The brokers are more enthusiastic about , which was recently formed by changing the management and remit of BlackRock Income Strategies and merging it with Aberdeen UK Tracker Trust.

The resulting vehicle targets total returns of the London Interbank Offer Rate plus 5.5% over a rolling five-year period, pays an attractive quarterly dividend and aims to limit its discount to 5%.

It invests globally using a diversified multi asset approach via quoted and unquoted investments.

At the end of July 2017 roughly a quarter of its portfolio was in equities, a quarter in fixed income and the rest in alternatives.

The latter are mostly accessed via listed closed-ended funds offering exposure to such uncorrelated assets as insurance-linked securities, aircraft leasing, healthcare royalties, infrastructure, marketplace lending and asset backed securities.

Managers Mike Brooks and Tony Foster inherited some of these holdings when they took charge in February 2017, but others were introduced as they overhauled the portfolio.

The teams at Winterflood Securities and Numis warn that it will take time to establish how well Aberdeen performs, but they are encouraged by Brooks' and Foster's good track record managing similar open-ended funds, and by their ability to draw on Aberdeen's substantial internal resources.

Nick Greenwood, manager of , has far less in-house support. Instead, he uses his knowledge of the closed-ended sector to invest in closed-ended funds trading on unjustifiably wide discounts, and then seeks ways to enhance shareholder returns.

His trust performed strongly in the run-up to the 2008 crisis, but suffered a swingeing 44% fall in NAV total return that year. He has had another great run over the past 12 months, but he needs to keep up the good work, as investors in his fund have the right to redeem all or part of their holdings in 2018.

Cautiously optimistic investors might prefer , which has a well-supported team in charge, although lead strategist Alan Borrows is retiring at the end of 2017.

Its long-term strategic asset allocation is 'positively oriented', with 60% in equities (split 35 and 25 % between UK and overseas equities), 15% in fixed income (currently only 9%) and 25% in specialist assets.

UK equities are managed in-house with a value orientation, and the rest is managed through third-party funds, with the overseas equity exposure similarly value-oriented. The specialist assets are expected to boost the yield.

Its objective is to grow NAV returns by the Consumer Prices Index plus 6% annually over a typical investment cycle, and grow annual dividends at least in line with inflation. It has performed encouragingly since adopting an absolute return mandate in 2012.

Its managers believe it is time to think about the next global economic contraction, which they anticipate in or around 2020. They therefore expect to reduce the trust's equity weighting over the next two years, so that by the time economic decline is more pronounced, it should be 'materially underweight'.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.