Two new shares join star mid-cap portfolio

23rd October 2017 13:38

by Lee Wild from interactive investor

Share on

This month, the made a record high, hitting 20,300 for the first time. It's up over 11% in 2017 so far, more than twice as much as the and its pack of international heavyweights. But there are plenty of great mid-cap companies that could go onto better things.

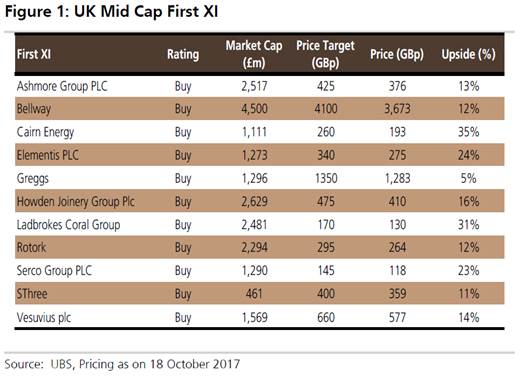

That's the view of broker UBS, which has just named its latest UK Mid-Cap Top Picks - it's First XI - which features high-conviction ideas from across its UK research team.

Since inception in December, the list is up 17.3% versus 14.9% for the FTSE 250, aided by gains of 50% for and 40% for . They, along with , are among the star performers since the last update in August, all up over 8%. Positive results have , and up over 5%.

There have been a couple of changes at this latest review. Outsourcer and pumps and valves engineer replace mobile handsets and electricals chain and turnaround specialist .

Dixons gets the chop after a 22% plunge during the period following profits warnings, while evidence of weakness at one of its smaller businesses is enough to lose Melrose its place in the elite squad.

There's excitement around Serco at UBS, which sees an inflection point in earnings momentum in 2018 as the company shifts into sustainable organic growth and margin improvement.

"After underperforming by c80% since 2012, we see the next 12 months to bring evidence of structural growth in outsourcing, improved sales effectiveness, and better pricing of contract risk," says analyst Rory McKenzie.

"We forecast >20% [operating profit] compound annual growth rate FY17-21e, but also see improving earnings quality and lower volatility ahead. We see an attractive entry point with Serco back to near-max pessimism on 0.45x enterprise value/sales."

Rotork is one of the UK's premier engineers, noted for its resilience through economic cycles. However, it has struggled because of exposure to the oil & gas sector, with organic sales down between 2014 and 2016.

"A change of CEO (with an interim phase of executive chairman Martin Lamb in the breach) can be a positive catalyst in our view for a return to operating margins of c25% and improved growth," writes analyst Mark Fielding.

"Our detailed cost base analysis shows significant cost creep since 2011 and we see this as creating an opportunity to improve profitability regardless of the end market backdrop. Combined with a valuation that has moved in line with the sector relative to its 10-year average premium rating of c30%, this supports our 'buy' case."

After the October rejig, the overall First XI now looks like this: Ashmore, Bellway, Cairn Energy, , Greggs, , Ladbrokes, Rotork, Serco, SThree and .

It's also worth reminding ourselves of UBS's recent FTSE 100 most/least favoured names, when B&Q-owner replaced software giant in the least-favoured list, joining , , and .

Most favoured at UBS are , , , , .

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.