Here's how well our model portfolios performed this quarter

1st November 2017 18:02

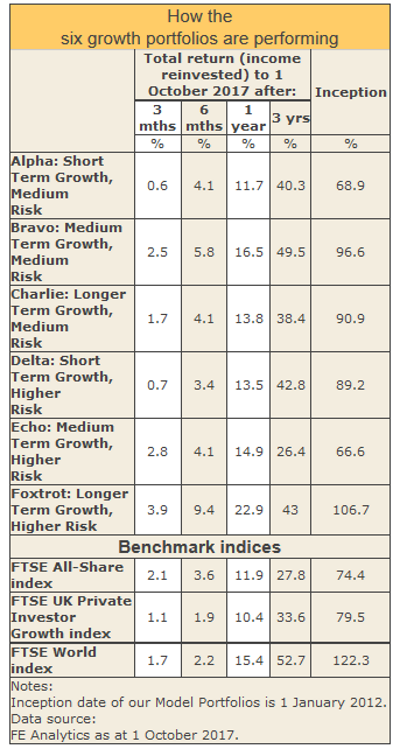

It has been a subdued summer for investment markets. That's clear to see in benchmark index performance: the FTSE All-Share index has gained 2.1% over the past three months to 1 October, and the FTSE World index 1.7%. It seems investors are adopting a wait-and-see approach as Brexit negotiations play out and the Bank of England decides whether or not to raise interest rates for the first time in a decade.

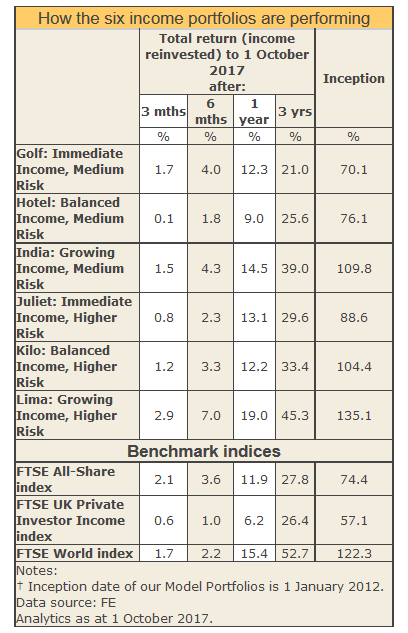

Our model portfolios, however, have done reasonably well, particularly against the FTSE UK Private Investor index series. Compared with the Income index, five of the six incomeoriented portfolios beat its 0.6% return, again led by Lima. Our higher-risk growing income portfolio gained 2.9%, further cementing its lead over the other five income portfolios for all time periods we monitor.

Lima also compares very favourably against the Growth portfolios, four of which beat the 1.1% return from the UK Private Investor Growth index over the quarter.

Growth portfolios

As further evidence that higher-risk strategies are continuing to reward investors this year, Foxtrot, the longer-term and higher-risk basket, has been the top-performing portfolio over the past three months, returning 3.9%. That is more than three times the return of its benchmark, the FTSE UK Private Investor Growth index.

Of note is the decision by to combine its redeemable and ordinary share classes – we hold the latter, which gained 3% over the quarter. The redeemable shares were launched in 2002 as a way to help offset any cash drag (when money gets raised but takes time to get invested), and the company has the right to redeem them at par value to prevent surplus cash hurting performance.

Ben Yearsley, director at Shore Financial Planning, explains: "In a nutshell, this is a simplification of the capital structure that should be good for shareholders. It could lead to a narrowing of the discount and the trust's eventual entry into the FTSE 250."

The strongest performer in the Foxtrot portfolio is the . Indeed, Giles Hargreaves' fund – a five-time Money ObserverRated Fund – is the second-best performing fund across all of our portfolios' holdings over the quarter. It has returned 6.4% over the past three months, and has almost tripled investors' money since Foxtrot's inception.

The fund is not the only growth-oriented holding with a small and medium-sized company focus to have excelled in recent months. Also among our top performers are , up 6.5%, new incumbent , up 3.8%, and , up 3.7%.

Positive sentiment towards smaller companies typically indicates that investors are feeling better about the outlook for the UK economy. In times of uncertainty, such as after the EU referendum or around the general election, investors have preferred the comfort of large-cap companies with a high level of international earnings.

Echo, the higher-risk, medium-term growth option, is our next-best performing growth portfolio, up 2.8% over the period; that's in part due to strong performance from the , which we added at the last review. It is up 2.3% over the quarter, helped along by high allocations to the fast-growing economies of Taiwan, South Korea and India.

has also contributed to decent performance in Echo as well as Foxtrot, but its chunky share price premium to net asset value is something of a concern. Typically, a premium of more than 5% is considered too high and RIT's has been around this level for much of the past year. Selling a trust at a high premium means pocketing extra profi ts (as long as you bought for less), but we would be reluctant to replace the £3.1 billion trust because its focus on capital preservation as well as growth has served the portfolios well since we introduced it in January.

Bravo, up 2.5% over the quarter, could be due for a change at the next review after a shake-up to the team was announced. The fund has been a mainstay in three of our portfolios – it also features in Charlie and Echo – and has gained 14% in the past year and 62% over three. However, any management change is a signal to review a fund.

It was revealed in June that Gianluca Monaco, who had been an equity manager with the firm since 2010, had left the business as part of a reshuffle. While the reshuffle has not impacted short-term performance, we will be keeping an eye on it.

Alpha, the shorter-term, medium-risk portfolio, has disappointed this past quarter, with gains of just 0.6%. The has been one of the weakest holdings in all our portfolios, down 1.7% over the quarter and barely registering a gain in the past year.

In Charlie, the medium-risk, longer-term growth basket, we are also keeping an open mind on our decision to keep , which we removed from Delta and Echo in the previous review back in August. The fund is down 1.6% over the past quarter, lagging its peer group and benchmark. Managers David Gait and Sashi Reddy focus on quality companies with strong fundamentals and sustainable, predictable growth, favouring those businesses that treat their investors well.

Darius McDermott, managing director at Fund Calibre, says: "Its underperformance is largely down to style. Quality companies have been underperforming in recent months and the fund is a long-term investor in such companies." He also points out that the fund has missed out on strong performance from South Korean stocks; the managers don't invest in the region because they are not keen on governance there. If this poor recent performance continues, we may look to replace the holding next time. Stewart Investors declined the opportunity to comment.

Income portfolios

Our decision to introduce to Lima, the higher risk, growing income portfolio, looks to have been well-timed. The trust is up 2.2%, largely undisturbed by the German election and ongoing Brexit negotiations.

Lima is again the best-performing income portfolio, gaining 2.9% over the past three months. It is also the top performer among all 12 model portfolios since launch in January 2012, since when it has risen by 135%.

Two long-term holdings have continued to propel Lima forward in the last quarter: and . The latter fund focuses on smaller companies, which have returned to favour this year, helping the fund post the third-best gain among all portfolio holdings, of 6% in the past quarter and 24% over a year. It is also a member of Kilo, the higher-risk, balanced income portfolio.

New holding has had a decent first quarter in the Golf and Juliet immediate income portfolios. The UK property trust has returned 3.4% over the period, marginally outperforming , which we suggested new investors sell in the last review because of its high premium.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks