Autumn Budget 2017: Preview

17th November 2017 16:00

by Emil Ahmad from interactive investor

Share on

American poet William Cullen Bryant described autumn as "…the year's last, loveliest smile". In a similar vein, the Conservative party will be hoping that the Autumn Budget will provide a last gasp victory in a year where political battles have taken their toll.

From a damaging June election to cabinet insurgency, it could be argued that May's government is teetering on the edge of collapse. Chancellor Philip Hammond is an equally precarious position, enduring the wrath of Eurosceptic Conservatives for Brexit policies that Nigel Lawson recently described as coming "very close to sabotage".

Nevertheless, the inaugural Autumn Budget - it's not the Autumn Statement anymore - will afford Mr Hammond the opportunity to restore some semblance of order to a government struggling to silence the doubters. As market attention and political focus is briefly diverted from Brexit, now is an opportune time to consider what the chancellor may have in store for us on November 22nd.

The budget and your portfolio

If history is anything to go by, it's highly likely there'll be some element of change to pensions. Only one budget since 2010 has failed to shake up the industry in some way shape or form.

Experts aren't predicting any surprises this time, however. For life insurers, UBS expects further reductions to the annual allowance (AA), although tax relief changes will be deferred. Watch for further clarity around changes to the Ogden rate, used by courts to decide lump sum compensation awards - and would benefit most here, says UBS. There may also be whiplash reform. Probability 9/10

Launched in 1995, London's AIM market has generally weathered storms successfully, with a lighter regulatory touch ensuring continued popularity. Considered to be one of the world's most innovative growth markets, AIM's constituent companies reflect its global reach.

However, the budget might provide some headwinds by reducing inheritance tax (IHT) benefits associated with AIM investments.

AIM-listed shares can be exempt from IHT if held for a minimum of two years and property or investment portfolio management is not the primary business function. This offers a way of circumventing the 40% IHT rate applied to individual estates above the £325,000 threshold.

Considering the inherently risky nature of AIM and the generous tax breaks, wealthier investors will be the biggest losers here if Hammond rings the changes. Probability 5/10

Venture capital trusts (VCTs) could also come under the chancellor's scrutiny next Wednesday. VCTs invest in start-up companies and investors currently enjoy very generous tax breaks due to the more speculative nature of these trusts. Tax relief of 30% can amount to a £60,000 'saving' per year if the maximum investment is made.

These trusts have been subject to greater regulatory restrictions in recent years, as the government tries to refocus their investment mandate on riskier start-up businesses. As a relatively niche investment vehicle, the savings may not be significant enough to prompt government action. Additionally, with the cloud of Brexit depressing the investment environment, the government will be reluctant to further impede start-up growth. Probability 4/10

Sticking with the equity theme, dividends may be about to suffer further from the chancellor's tax mandate. With company owners and investors already bracing themselves for a 60% reduction in their tax-free allowance from April 2018, the belt could be tightened even further.

An additional reduction to next tax year's £2,000 allowance has been described as a "quick win" for Mr Hammond. Investors currently enjoying a £5,000 tax free threshold have already suffered from diminishing 'returns' in recent years, and this may prompt outflows from standard investment products.

Alternatively, the chancellor could simply raise dividend tax rates, which currently stand at 7.5% (basic), 32.5% (higher) and 38.1% (additional). If either of these options become a reality, ISAs and SIPPs will likely be the main winners due to their tax-efficient properties. Probability 6/10

The generation game

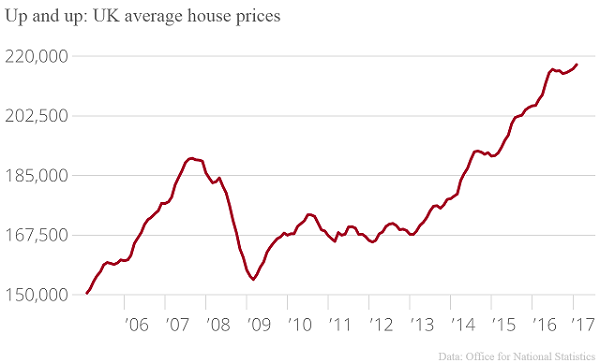

The housing market remains reasonably resilient in the face of Brexit uncertainty, with some indicators supporting a fairly bullish outlook. The Halifax House Price Index indicated that prices are rising at their fastest rate since Q1. However, this is possibly reflective of an increased demand for the best mortgage deals prior to the rate hike.

Weakness is still prevalent in the London and eastern England markets, especially at the higher end of the property ladder. New market entrants clearly need all the help they can get and London is a case in point; an average property price of £428,546 for first time buyers equates to almost £11,500 in stamp duty.

It appears Mr Hammond could be paying attention to these recent Land Registry statistics, as stamp duty may be waived for new buyers. Potentially funded by tax increases on the purchase of additional residences, this could be a positive driver for housebuilders as well. With the 'Help to Buy' scheme set to receive a further £10 billion cash injection, this rebalancing of a generational economic divide seems a fairly good bet. Probability 8/10

As the Conservatives' efforts to re-engage with millennials gathers pace, certain aspects of the budget may cater towards this younger demographic. There is an outside chance that No 10 may cut National Insurance Contributions for workers in their 20s and 30s.

After the election fallout, raising the headline tax rates (income tax, VAT, NI) would be political suicide. Therefore, as the Telegraph recently noted, a reduction in pensions tax relief could allow the government to "…restack the deck for the next generation'.

However, drastic tax measures of this nature risk alienating elements of the government's core voter base. Moreover, with Brexit probably limiting such bold moves, the likelihood of this NI cut coming into effect is minimal. Probability 3/10

Barely a day goes by without media headlines proclaiming the death of the high street, as the squeeze on households' disposable income grows and consumption falls. There is little doubt that, while inflation significantly outpaces weak real wage growth, the struggling UK workforce needs a helping hand.

Although a 2020 implementation date gives the government some breathing room, pressure is mounting on the Conservatives to increase the personal allowance earlier. Raising the ceiling to £12,500 now will help to partially offset the effects of inflation and increase consumption, something the retail and property sectors would both welcome. Probability 5/10

Business is booming?

Recently referred to in the press as a potential "tipping point" for the economy, the 4% rise in business rates due in the new tax year could be under threat. Hammond is under intense pressure to scrap this increase, with the British Chambers of Commerce leading the charge.

In conjunction with factors such as the higher national living wage, pension auto-enrolment and rising import costs, this could be the final nail in the coffin for many businesses. The lobby groups have been presenting a united front in their message; the rate rise will damage confidence, reduce investment and potentially lead to a mass company exodus prior to the March 2019 Brexit deadline.

Tens of thousands of businesses represent a pretty formidable voice and Chancellor Hammond would be a brave man to disregard this entirely. If this does come to fruition, a rebound in the retail sector is likely. Probability 6/10

The 'b' word

It would be impossible to mention the budget without making reference to Brexit preparations. An additional £250 million of taxpayers' money has been allocated to prepare for a hard 'no deal' Brexit scenario. This will help departments make contingency plans in the event that no trade deal can be negotiated.

Despite being initially ruled out by the chancellor, Theresa May quickly pulled rank during Prime Minister's Questions in October. Responding to a question from Brexiteer Iain Duncan Smith, May stated, "We are committing money to prepare for Brexit, including a no-deal scenario". Probability 9/10

The conservatives have clearly been in choppy political waters lately and, while the budget is unlikely to be a case of plain sailing, the government will be in damage limitation mode. As the shadow of Brexit looms ever closer, Phillip Hammond is likely to err on the side of caution with economic confidence remaining fragile.

While budget predictions are notoriously unreliable, the odds are certainly in favour of one outcome; millennials will benefit to some degree as the government attempts to bridge a widening generational gap.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.