US equities: Why they're still impossible to ignore

23rd November 2017 12:51

by Dzmitry Lipski from interactive investor

Share on

After Trump won the US election in November 2016, a number of equity indices hit all-time highs following the billionaire's promise of massive spending on infrastructure. Resulting inflationary pressure could make equities more attractive.

Trumps pro-business proposals included: lower corporate taxes, a tax break on overseas profits, at least $500 million infrastructure spending – but possibly double that - and financial deregulation.

However, investors' expectations have started to fade as the president has found it difficult to get his policies through Congress and into law, raising a question mark about the recent rally in equities.

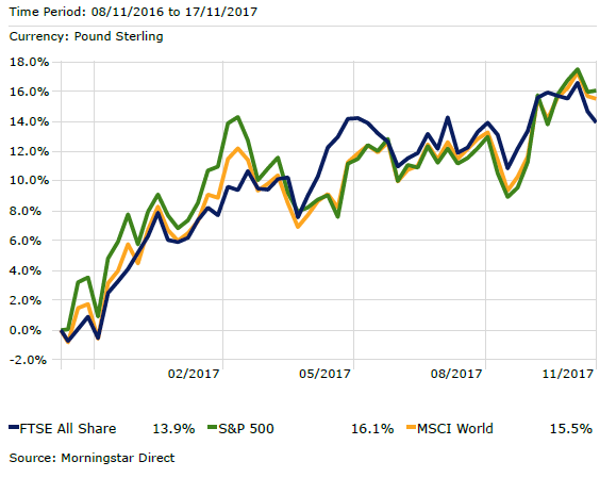

Since the election a year ago, the S&P 500 has risen by 16.1% and the FTSE All-Share by 13.9%, while global stocks are up 15.5% as measured by the MSCI World index, and at all-time highs, too.

It should be noted that the equity bull market is entering its ninth year, and for US stocks this is the second-longest bull market since WWII (the longest was 1987 to 2000). This one differs from the 1987-2000 period in that interest rates have fallen throughout.

Bond yields have also declined to historically low levels. The major concern now is that a chunk of recent equity returns have been driven by investors bidding up prices in the global hunt for yield, while earnings have remained flat.

While investors are currently in a state of cautious optimism, there is uncertainty about whether markets are currently expensive and where they should allocate money globally. What's more, investors are jittery about Trump's contradictions and unpredictability which make it difficult to decide how to react.

What remains clear is that the possibility of Trump implementing his fiscal proposals would likely shift the focus from passive investing in equity indices to investment in individual sectors and equities expected to benefit from these policies. For example, stocks in the financial sector, such as banks and insurers, would benefit most from proposed financial deregulation.

Against market concerns, the US underlying economic data is encouraging: GDP growth is healthy at 3%, unemployment is low at 4.1%, and corporate earnings are solid. The Federal Reserve is still bullish enough to raise interest rates and to start balance sheet reduction, which signals significant long-term confidence in the economy, despite inflation remaining below target of 2%.

Investors argue that while the S&P 500 has delivered strong returns since its 2009 lows, continued economic and earnings growth mean US equities remain attractive to keep owning. Meanwhile, there is still hope of US fiscal policies, such as corporate tax cuts, which is likely to provide a substantial boost to corporate earnings.

As US equity valuations currently looking stretched, investors could reduce their allocation and instead look to other regions such as emerging market and European equities, or even other asset classes such as commodities and property.

Despite this, the US equity market is hard to ignore for investors, making up almost 60% of the MSCI World Index and is also home too many of the world's most profitable companies: , , , , , , and .

The composition of the US market is particularly interesting for UK investors, since our own stock market is heavily concentrated in just three sectors: financial services, energy and materials. Among the largest sectors in the US market, by comparison, are technology, healthcare and consumer discretionary. Therefore, many investors consider the US should be an essential part of any globally diversified portfolio.

Funds for investing in the US equity market

FUND:MA7A:Artemis US Select

The fund aims to deliver long-term capital growth by investing in the 'best ideas' portfolio of 40 to 60 companies. An experienced manager, Cormac Weldon, adopts a flexible approach to stock-picking, changing focus as the economic and market cycles change, with the aim of delivering returns in different conditions.

Technology, consumer discretionary, and healthcare currently dominate the portfolio, accounting for 60%. The manager believes that the economic background is supportive, and moderate growth will carry on into 2018. Earnings expectations for the market as a whole have risen further and are now expected to grow by 10% this year. The manager has reduced his allocation to financials, particularly regional banks, as it became clear that the proposed tax cuts and deregulation by the new administration would take longer to materialise.

FUND:0V2R:Schroder US Mid Cap

The fund aims to provide capital growth by investing in equities of small- and mid-sized US companies. The manager, Jenny Jones, invests in companies with compelling business models, strong management teams, and attractive valuation levels. She adopts a flexible approach, responds rapidly to any economic changes and looks for a mix of mispriced growth stocks, 'steady eddies' and businesses on the brink of a turnaround.

Presently, the portfolio is cautiously positioned: underweight in financial services and materials companies, overweight healthcare and consumer discretionary stocks and positive about the outlook for the housing sector. The manager believes in the underlying strength of the US economy and this makes a strong case for allocations in US equities.

Given current trends, the potential for lower corporate tax rates, and improved global trade, a shift in allocation to smaller and medium-sized stocks should be a profitable move for investors.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.