Best funds to invest in the finance sector

30th November 2017 14:43

Investors have been wary of investing in the financial sector since the global financial crisis of 2008. Along with low capital buffers and the rising number of non-performing loans, low interest rates were the main concerns for investors as these negatively impact profitability at banks and insurance companies.

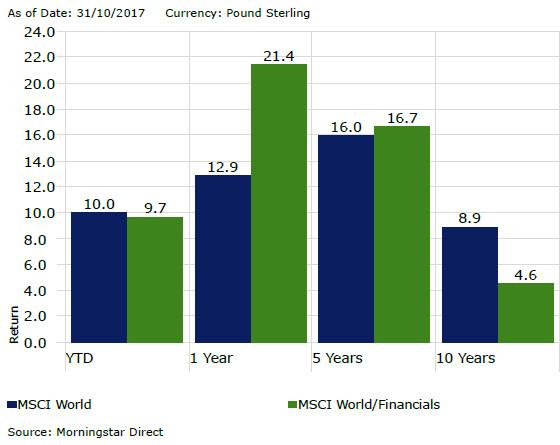

No surprise, financial stock, especially banks, have hugely underperformed the wider market over the past few years. But the sector has undergone dramatic changes since then, with many financials managing to rebuild their balance sheets and return to profitability.

Regulations like Basel III (for banks) and Solvency II (for insurance companies) have forced banks and insurers to reduce their leverage, scale down risky assets and improve liquidity.

While the sector is still challenged in the low growth, low yield environment, the backdrop has shifted to one of reflation, and the performance of this sector has turned a corner.

Financials have done well since President Trump's election win last November, boosted by the promise of less restrictive regulation during his administration, lower corporate taxes, greater infrastructure spending and the prospect of rising interest rates in the US.

However, these are yet to fully materialise and potentially translate into improvements in net interest margin.

Both equities and bonds of financial companies began to outperform during the middle of last year, and things have picked up recently. Investors argue that, despite a strong recovery, the opportunity is far from over as sector valuations remain relatively inexpensive and the outlook is attractive right now.

For value and contrarian investors, financials are offering some of the best opportunities not only in equities but also in bonds.

Even though the financial sector is dominated by banks, there are also opportunities in sub-sectors like financial technology (e.g. online payment and digital platforms), financial services (asset managers, rating agencies & stock exchanges), and insurance and in emerging markets.

As these may respond differently to changing economic conditions, this can help with diversification.

One way to gain exposure to a wide range of different financial companies across several geographies and subsectors is to consider investing in a global financials fund.

Money Observer Rated Funds:

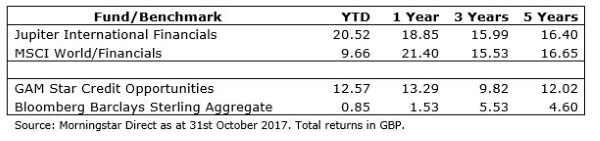

Jupiter International Financials

invests principally in equities of financial sector companies in both developed and emerging markets, as well as the various sub-sectors of the financial industry. It can also hold other types of investment if the fund manager thinks that is appropriate for the market conditions, for example bonds, cash or derivatives.

Manager Guy de Blonay, boasting one of strongest long-term track records across the industry, aims to identify major structural trends and themes in financial services, and identify companies with prices that do not yet reflect the benefits.

While a significant portion of the fund is invested in banks such as , and that are more interest rate-sensitive, the fund has a sizable exposure to the disruptive financial technology and payment processing sectors which, in the manager's view, should continue to grow, regardless of whether interest rates increase.

The fund has exposure to companies like Temenos, a global leader in banking solutions, and digital payments businesses like and , as well as traditional credit card companies and .

In addition, it typically has a significant weighting to emerging markets, with holdings such as Russia's Sberbank, Brazil's Itau Unibanco and India's Indiabulls Housing Finance and Yes Bank. This makes the performance of the fund less dependent on developed markets lenders.

GAM Star Credit Opportunities

is a specialist bond fund that focuses on the junior and subordinated debt of investment grade companies. It is managed by Atlanticomnium's Anthony Smouha, who has more than 30 years of experience, on behalf of GAM.

The manager believes that that there is a very low likelihood that quality financial companies will default on their debt, which means the portfolio can pick up extra yield by holding lower tier debt issued by these businesses.

The fund invests mainly in investment grade issuers, but the manager is prepared to go down a company's capital structure to find the best combination of yield, value and capital preservation.

One feature of the fund is the substantial holdings in financials at 76%. The manager stresses that the yields on his fixed rate securities are significantly above those of UK gilts, with many of them still earning 5-6% or more for names such as , and National Westminster.

He has recently replaced some of the portfolio's long-dated insurance bonds with contingent capital securities of , Coventry, and Lloyds Bank where the outstanding period to interest re-fix provides yields above 5% and the duration is much shorter. Thus, they will be less affected by rises in government bond yields.

The manager's ability to invest in junior and hybrid debt ensures there is duration protection in case of a normalisation of interest rates. While the fund's allocation to fixed-rate bonds benefit when rates go down, it's position in floating-rate notes should outperform when interest rates go up. That means the fund is much less volatile than the bond index.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks