Europe: A sweet spot for investors

7th December 2017 13:30

by Dzmitry Lipski from interactive investor

Share on

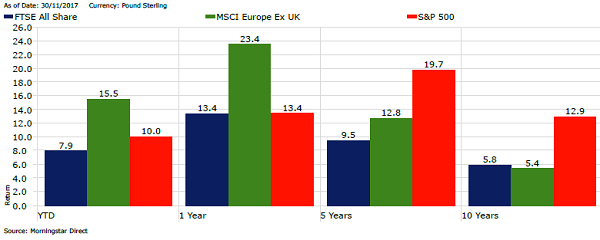

European equities have lagged UK and US counterparts significantly since the financial crisis, but have started to catch up this past year. Over the last 12 months, MSCI Europe index returned 23.4% in sterling terms, nearly double the returns for both and S&P 500.

While many investors are still cautious about investing in Europe, the outlook is getting brighter. European equities are seen to become a sweet spot for investors as the economy continues to recover, with earnings growth coming through.

After last year's large outflows triggered by political uncertainty with the rise of populist parties, flows have stabilised as Macron and Merkel won elections this year that's led to an increase in investor confidence across the region.

The European economy is growing faster than UK and US as unemployment is falling and consumption is rising. According to data released today, Q3 eurozone GDP grew at 2.6% year-on-year - the fastest growth rate since 2011.

The unemployment rate dropped to 7.4% in November, the lowest level since 2009. These results could be attributed to extremely loose monetary policy implemented by the European Central Bank (ECB), such as low interest rates and quantitative easing (QE) over the last years to boost economic activity.

Unfortunately, relatively benign growth is still not translating into higher inflation, currently at 1.5%, which remains below the ECB's target of 2%. For this reason, the ECB is expected to keep low rates unchanged for a while, although it is considering QE reduction from January next year.

Another concern for investors has been strengthening euro following stronger growth, and expectations of tighter monetary policy from the ECB. This could be a drag on European recovery.

However, investors should keep in mind that roughly 50% of revenue generated by European companies come from domestic demand, meaning the effects of the rebound in consumption on the recovery are more relevant than the risk of a stronger euro.

As evidence, the equity market has been resilient to a strong euro because the growth is domestically focused rather heavily dependent on currency devaluation.

Moreover, European companies are likely to deliver better earnings that than UK and US companies this year. Earnings per share growth has been increasing and investors expect this strong growth to continue.

Profit margins, which have lagged the US since 2009, have begun to improve and have significant scope for further expansion.

European equities have significantly underperformed the UK and US equities since financial crisis, and this has created an opportunity to purchase equities that are cheap on a valuations basis.

While US equities are at present overvalued, strong fundamentals and positive growth have not been priced into European equities. The MSCI Europe ex-UK index is trading at 15.2 times estimated forward earnings, compared with 17.9 for the S&P 500.

Interestingly, the recovery in European equities has been very broad-based and, therefore, offers diverse opportunities, unlike the US equity market, which is far more concentrated.

In the US, this year, a big share of market gains in the S&P 500 is concentrated on the top 10% of contributors, mainly the famous FAANG stocks.

In contrast, gains in Europe is more widely distributed, with many sectors offering value. Additionally, many European companies are more exposed to emerging markets than is the US.

Investors should remember that the US is a large and important equity market, so some US exposure within a global well diversified portfolio is highly recommended, but Europe is where better value opportunities can be found right now.

No surprise that highly experienced fund managers from Money Observer's Rated List are still finding good opportunities for their funds to deliver positive returns by picking on high-quality, domestically-focussed companies that should benefit from Europe's economic recovery.

These include:- , , and .

Certain sectors should benefit from rise in domestic demand, for instance industrials, healthcare, consumer discretionary and professional services sectors.

The financial sector is also interesting - banks are generally undervalued and stand to benefit from tighter monetary policy signalled by the ECB.

| Money Observer Rated Funds | YTD | 1 Year | 3 Years | 5 Years |

|---|---|---|---|---|

| FP CRUX European Special Situations | 19.54 | 24.57 | 17.68 | 16.58 |

| Marlborough European Multi-Cap | 19.94 | 25.97 | 27.09 | 19.52 |

| TR European Growth Trust | 30.35 | 39.22 | 27.1 | 25.32 |

| MSCI Europe Ex UK | 15.51 | 23.45 | 11.16 | 12.75 |

Source: Morningstar Direct as at 30th November 2017. Total returns in GBP

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.