Difficult first month for Winter Portfolios

8th December 2017 15:30

Statistics demonstrate that share prices typically do better over the six winter months than over usually quieter summer period. Investors able to exploit this anomaly would have enjoyed market-beating returns.

According to data from The UK Stock Market Almanac, starting with £100 in 1994, an investor who had been invested in the market continuously for the past 23 years would have seen their money grow to £251 (excluding dividends).

However, if they had only invested in the market between 1 November and 30 April every year then that £100 would be worth £326. Investing only over the summer months would have seen the original £100 shrink to just £70.

So that investors could take advantage, we set up our own winter portfolios. In the three years since inception, our Consistent Winter Portfolio - the five most regular outperformers over the past decade - have returned an average of 18% versus only 3.5% for the .

For more adventurous investors, we relaxed the rules a little to pick the biggest average annual returns over the past decade. To compensate for the obvious increase in risk, the average annual profit over the past decade hits 32%.

Click here to read more about our 2017-18 Winter Portfolios.

One month into this year's seasonal portfolios and it's time to run through the numbers. It's not be a great start, true, but we've been here before, and the first month is rarely an accurate indicator of where we'll be at the end of April.

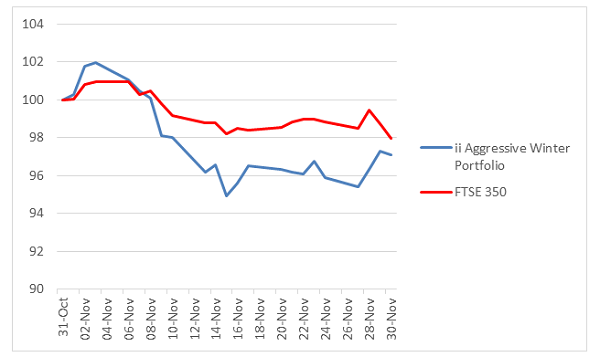

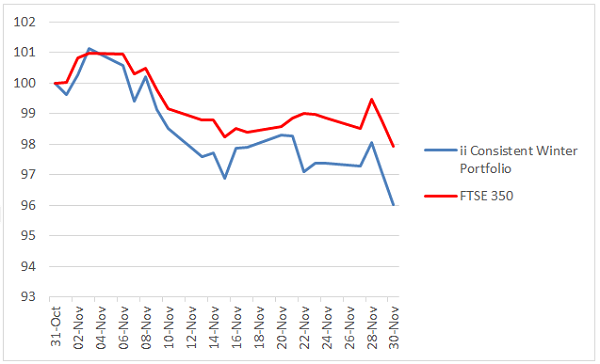

Amid concerns about the UK's exit from the EU, sterling at a two-month high, a series of high-profile profit warnings and company valuations, the FTSE 350 finished November down 2.1%. Our Aggressive Winter Portfolio fell 2.9% and the Consistent Winter Portfolio ended the month down 4%.

We're not worried, however. The benchmark index made an identical start to last year's strategy when the consistent portfolio dived 5%, and back in 2014 when he started with a 1.7% decline. It ended those years up 9.5% and 14% respectively.

Aggressive Winter Portfolio

The aggressive portfolio did so well last year that we flagged concerns some of the constituents might have got ahead of themselves. Equipment rental giant Ashtead was one of them. Big in the US, the firm grew its market cap by almost 28% during last year's portfolio. In November this year it fell 2.1%, in line with the FTSE 350.

Liberum retains confidence in prospects. There's a second-quarter update due next week, and the broker thinks will update the market on the potential impact of Hurricanes Harvey and Irma, plus US tax reforms. The shares are a 'buy' up to 2,030p, it says.

Despite chancellor Philip Hammond's 'housing budget', builder posted modest losses, too, in line with the market. Its share price surged over 40% last winter, but they're still cheap on traditional valuation metrics and yield over 7%.

Tracksuits-to-trainers retail chain - up 46% in the last winter portfolio - and serviced office firm IWG - up over 30% - let the side down, both falling around 8%.

We thought the latter had got the bad news out of the way with a profit warning mid-October, blamed on Brexit and natural disasters in the US. The firm, formerly known as , lost a third of its value in the aftermath, but clearly there was more selling to be done. American rival WeWork is clearly a threat.

It's a case of 'best til last', and hats off to the new boy. Builders' merchant ended the month at a five-month high following a near-6% gain in November. There has been concern around consumer weakness, but its development programme and restructure of the Plumbing & Heating business show promise.

Consistent Winter Portfolio

Like the aggressive portfolio, the Interactive Investor Consistent Winter Portfolio had a great winter 2016-17, ending the six months with a near-10% profit.

Heat treatment specialist was star of the show, delivering a return of 40% as profit upgrades flowed thick and fast. We hear that sales momentum remains in the fourth quarter, but comparisons with Q4 2016 are much tougher, so growth will slow. With few positive catalysts, the shares ended month one down 7.5%.

Irish building materials firm was a major beneficiary of Donald Trump's election promise of infrastructure investment and tax reform. Unfortunately, the share price, which has moved sideways since, lurched lower following last month's third-quarter update and ended the month down 9.5%.

But after a mixed 2017, broker UBS is optimistic, believing an improving business profile and prospects for improved trading conditions in 2018 are not priced in. It blames CRH's acquisition of assets in the US at trading multiples above where the shares trade.

"At current multiples, the shares trade at a discount to other heavy side peers in Europe and an even more dramatic discount to US listed peers."

Caterer fell more than 9%, too. Peers have already warned on profits and investors are sceptical after the firm said growth and margin improvement will be weighted to the second half.

Winter portfolio favourite narrowed the deficit with a 2% gain for the month. We shouldn't be surprised, it's hasn't let us down yet – the speciality chemicals firm has risen each winter for at least the past 13 years. Third quarter numbers were so good that UBS upgraded its price target from £43 to £46. The shares currently trade at £42.50.

As with the aggressive portfolio, it was the new boy that done it! Hotelier finished with a 4.2% gain. There was no company specific news, but US tax reform could help here.

Get 25% off The Harriman stockmarket Almanac 2018! That's £18.75 (+P&P) for the print book or £15 for the ebook. Order at Harriman House, entering promotional code ii_ALMANAC2018 (for the print book) or ii_ALMANAC2018e (for the ebook), when you reach the checkout.

Stephen Eckett

Stephen Eckett started his career with Baring Securities and then later worked for Bankers Trust and SG Warburg, during which time he worked in London, Hong Kong and Tokyo. After settling in France, he co-founded Harriman House which has become a leading independent publisher of financial books in the UK. He also writes books on finance including, most recently, the Harriman Stock Market Almanac.

------------------------------------------------------------------------------------------------------------------------------------------------------------

ii publishes information and ideas which are of interest to investors. Any recommendation made in this article is based on the views of the writer, which do not take into account your circumstances. This is not a personal recommendation. If you are in any doubt as to the action you should take, please consult an authorised investment adviser. ii do not, under any circumstances, accept liability for losses suffered by readers as a result of their investment decisions.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks