Buy, hold, sell: Buy packaging, sell Swedish locks

12th December 2017 12:35

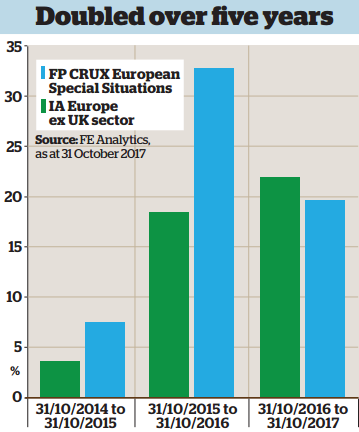

The aim of is to "buy global businesses listed in Europe", James Milne, co-fund manager, says. Milne has run the fund alongside Richard Pease since its inception in 2009. The fund now holds around £1.9 billion and over the past five years has returned 122%.

The managers focus on European companies - which account for 93% of its assets - that have "resilient earnings". The companies they invest in, Milne says, are those which they believe will be able to withstand downturns. The managers like companies that dominate niche markets. They also place a "heavy focus on good management", and are suspicious of shares on too high multiples and those with large amounts of debt.

Buy: Huhtamaki (HEL: HUH1V)

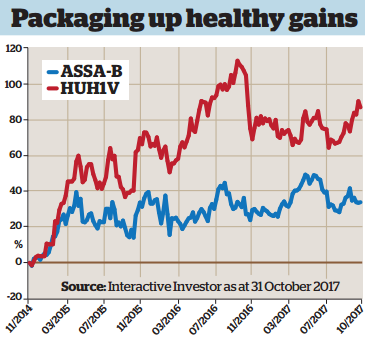

Huhtamaki produces food and drink packaging. Based and listed in Finland, one of its leading products is disposable paper cups for coffee. Within this market, Milne says, it has a "very secure global oligopoly. There are not many large peers in its sector that can make so many types of coffee cup."

Investment in the company, says Milnes, gives useful exposure to the growth of high-street coffee businesses and enables "piggy-backing off Costa Coffee". In the US also, there is a shift from plastic coffee cups to paper cups, giving Huhtamaki some attractive growth opportunities. The company also has growth potential from its other speciality: flexible packaging. Such packaging is popular for sale in many emerging markets, particularly India.

The firm's expansion in the US market has come with growing pains and associated costs. At the same time, changes to India's VAT system have resulted in a drop-off of growth in sales there. But these are both temporary blips, Milne believes, making the company a solid buy right now.

Bought: Small purchase in November 2016 at €35. Substantial purchase in August 2017 at €33.

Hold: Burckhardt Compression Holding AG (SWX: BCHN)

Milne points to as a share which, although it is not in the FP CRUX European Special Situations portfolio, would be an obvious choice to retain if investors already owned it.

Based in Switzerland, the company produces reciprocating compressors that use liquid natural gas (LNG) and they have a variety of industrial uses. Like Huhktamki, he says, it is "also quite a solid oligopoly, but making compressors, which gives it a large after-market". The margins on its products are quite high and the return on capital "way above 30 or 40 %". As an added bonus, the company has very rarely had any debt.

So why not buy? The market for LNG powered ships is very cyclical, and the LNG-powered shipbuilding industry is prone to over-investment. Right now, "no one wants to buy any such ships". Milne sums up Burkhardt thus: "Solid company, cyclical downturn for that industry." "If you own this," he says, "sit on it and wait for the cycle to turn."

Sell: Assa Abloy AB (STO: ASSA-B)

Milne held the Swedish lock making company for three years. When he purchased it, it was a business on the up. A few years before, the company had appointed a new chief executive who kick-started a large acquisition strategy.

The company began to buy up small, often family-owned locksmiths. At the same time, the locksmith industry was particularly attractive to Milne because it has a lot of pricing power: everyone needs to maintain or replace their locks.

So why sell? First, notes Milne, it looked as though the chief executive might leave the company (which he subsequently did after Milne sold out). He played a dominant role in the company's management, and Milne was concerned about what might happen after he left. Secondly, the price/earnings ratio had reached a multiple of 22 - too high, in Milne's view.

Finally, Milne felt that while initially successful, the acquisition strategy of Assa Abloy was starting to see diminishing returns. As it grew bigger, each new acquisition made less of an impact on the company. To continue growing at a similar rate, larger acquisitions would have to be found, adding a new layer of risk.

Bought: November 2013 at €317 (note: there was a 1 for 3 share split on 2 June 2015, therefore price would become €105). Sold: November 2016 at €164.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks