2018 ISA fund tips: Four ways to profit from US market 'melt-up'

18th January 2018 10:27

by Tom Bailey from interactive investor

Share on

Since Donald Trump was elected US president just over a year ago, the US has continued its second-longest bull market since the Second World War. The main question confronting the US in 2018, then, is how far markets can continue to climb.

According to Gavin Haynes, managing director at Whitechurch Securities, the economic backdrop in the US looks as though it will be still be strong in 2018. Growth appears to be solid and unemployment low, both of which should be supportive of markets.

Alongside economic data, key indicators to watch will be first-quarter earning results, notes Darius McDermott. Adrian Lowcock believes that financials and industrial earnings will see positive results. "Financials should also benefit from the withdrawal of QE and rising interest rates," he says, "while industrials could continue to profit from the period of global synchronised growth."

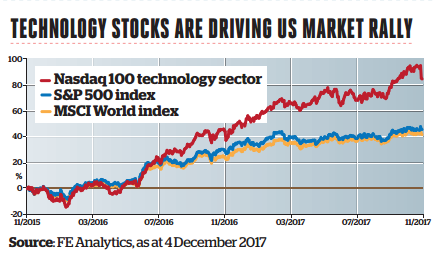

However, the technology sector will be key. Lowcock says: "Technology looks set to continue to dominate the market as earnings grow rapidly." That said, the strength of the technology sector has raised fears about a potential bubble.

Angel Agudo, portfolio manager of Fidelity American Special Situations, says: "In the past couple of years, the technology sector has been the primary driver behind the continued market rally. Such single-industry representation at the top of the broad-based US equity market is unprecedented, and has led to growing concerns that we are in another tech bubble, which could end in an impending crash."

However, Agudo says the scenario this time around is different from that in 2000. Many of the best-performing stocks "generate good cashflow and have sustainable business models". But there should be some caution. "Valuations on some of these stocks look stretched," he says, "and the market is not pricing in some of the regulatory risks involved."

More generally, the continued strength of US earnings may also depend on president Trump getting his legislative agenda passed, which, says Lowcock, "should be supportive of markets".

Is the US market still a good prospect for investors in 2018? As the largest and most important stockmarket in the world, it cannot be ignored. However, Haynes is cautious. He says: "Our key concern is stockmarket valuations, which appear elevated, while continued low volatility suggests complacency." All this means Haynes is taking an underweight position in 2018.

Agudo is also cautious. He says: "A large set of companies either look stretched from a valuations perspective or have reasonable valuations and safe business models but worse balance sheets." For Agudo, it is important in such an environment to be driven by fundamentals when picking stocks, and to take a bottom-up approach to identify the best shares in specific sectors.

At the same time, he notes, in 2018 it will be crucial to look for opportunities that provide good downside protection. Generally, he is "looking for investments that have some counter-cyclical characteristics, generate stable cash flows and have pristine balance sheets".

Others are more optimistic. McDermott says that he is "neutral on the outlook for the US market". However, one area in particular has grabbed his attention: small businesses. He says: "Historically, smaller companies outperform when interest rates rise, and we expect another two or three rises over the coming year."

McDermott concludes: "If you want a decent chance of making some money out of what could be the final stage of the US bull market, I'd suggest that mid and small caps are the place to go."

How to buy the US: fund and trust tips

(core growth)

TR 1 year 22.4%, 3 years 35.8%, yield 0%

Countless studies have concluded that over both short and longer time periods, active fund managers struggle to beat the S&P 500 index. Investors therefore need to either opt for one of the few active managers that have proved their worth over the years, or alternatively buy a low-cost tracker. For the latter option iShares Core S&P 500 ETF fits the bill, with an expense ratio of 0.04%.

(core growth)

TR 1 year 7.9%, 3 years 62.2%, yield 0%

An active fund that has earned its stripes across the pond. Managed by Jenny Jones since launch in 2005, the fund looks for 'mispriced growth stocks', 'turnarounds' and 'steady eddies' - companies that pay sustainable dividends. Alan Steel, who tipped the fund, says: "The fund has produced consistently strong performance, having outperformed the S&P index over 10 and 15 years."

Majedie US Equity (adventurous growth)

TR 1 year 8%, 3 years 43.4%, yield 0%

The US stockmarket has gone from strength to strength since shaking off the heavy losses it endured during the financial crisis a decade ago. But as a result, US equities now look expensive. According to the cyclically adjusted price earnings ratio, on only two occasions has the US market been more expensive - in 1929 and 1999. Therefore, those entering today should consider a fund that has "a value tilt", such as this one, says Burdett.

(adventurous growth)

SPTR 1 year -11.4%, 3 years -36%, discount -21.8%, yield 0%

PSH is a US-focused activist hedge fund. Launched in 2014, it has had a disastrous start, due to a nil exposure to the FAANGs (leading US tech companies) and poor stock selection. Charles Murphy sees it as one way to play the generally unpopular US market. "Stronger investment performance will likely result in the discount narrowing, offering investors the potential of a double whammy."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.