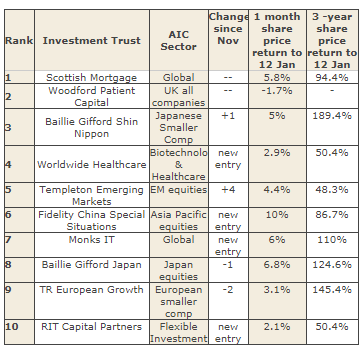

10 most popular investment trusts - December 2017

19th January 2018 17:23

has kept its position as the most popular investment trust among interactive investor users. Currently trading on a small premium of 2.45%, Scottish Mortgage has seen one year returns of 39%.

The second most popular trust in December was once again . Managed by Neil Woodford, the fund saw a yearly return of -11.1%. This has largely been the result of a few widely covered 'bad' trades made in 2017. Such trades led to some commentators and critics asking if the star fund manager had 'lost it' - questions to which he directly responded.

However, despite seeing performance dip, many investors still have faith in Woodford, due to the fact that over his 25-year plus career he has beaten the market more years than most. The trust's current steep discount, of 10.9%, has also drawn investors in, allowing it to keep second place in our investment trust league table.

In November, Baillie Gifford's two Japan equity focused investment trusts shot up the rankings, reflective of the increased popularity of Japan. In the latest figures for December, this has somewhat continued. continued this rise in popularity in December, despite its now rather steep premium, coming in at number three. Meanwhile, Baillie Gifford's other Japan focused trust, , fell by one place in the rankings.

continued to decline in popularity, falling to ninth most popular in December. In the previous month's data, the investment trust, which focuses on European small cap companies, fell from fourth to seventh place.

New entrants reflect recent trends

December 2017 saw several new entrants into the top 10 - each investing in generally different sectors that have seen growing enthusiasm from investor of late.

With China increasingly back on the radar for investors, entered the top 10. Fidelity China Special Situations was a strong performer last year, seeing yearly returns of 42.3%.

There continues to be much excitement about China's e-commerce and tech giants such as , and as well as the country's ongoing economic reform efforts. Despite China no longer achieving 10% growth rates, growth is still strong, expected to be at 6.9% for 2017. James Anderson, co-manager of Scottish Mortgage, recently wrote for Money Observer explaining why he believes "China is the future."

In the summer of the 2017, the trust was trading at a discount of 14%. Owing to increased interest from investors, that has now narrowed to 11.5% (as at January 16).

Another new entrant was . The trust holds a broad exposure of equities across the world, with 44.2% in North America, 21.2% in Global Emerging Markets and 17.2% in Europe and 8.2% in Japan. The popularity of the trust is perhaps reflective of increased optimism for global economic growth, with the world economy finally returning to synchronised growth for the first time since the financial crisis.

was another new entrant, flying past other funds to reach fourth place. The trust's new-found popularity may be due to increased optimism for biotech, a sector which constitutes a large of its holdings. Biotech became a hot investment theme in the late 2000s until it saw a correction around 2015. Since then it has started to see increased popularity, partly due to a perception that the Trump White House will take a more relaxed approach to drug pricing.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks