Eight funds and trusts for small-cap investors

1st February 2018 14:27

by Dzmitry Lipski from interactive investor

Share on

Smaller companies - superior returns

The UK smaller companies sector staged a strong recovery in performance last year following a sharp sell-off after the Brexit vote. Following the EU referendum in 2016, larger companies have outperformed their smaller counterparts, with support from a weak pound helping those who derive much of their revenue from overseas.

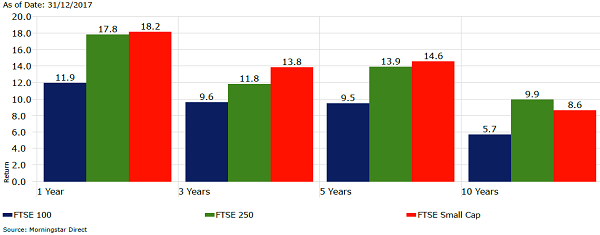

Despite a dip in 2016, long-term performance of smaller companies has proved positive for many investors. The and the index of mid-cap stocks have beaten the - the UK's index of biggest companies - over the past one, three, five and 10 years.

Some investors attribute longer term outperformance to small caps being flexible and growth oriented. It is also widely believed that the market for small cap equities is under-researched, underinvested, and generally less efficient than the market for large caps. It should, therefore, yield superior returns for investors.

Although broad index returns show that the share prices of smaller companies can outperform larger companies over the long term, the market tends to be volatile over shorter periods. Liquidity can also be an issue. These potential risks do deter some investors.

Despite this, smaller companies can offer a variety of investment opportunities as they represent a wide universe of businesses, many of which have huge potential for growth because they are often nimble, dynamic and innovative. This gives them the flexibility to expand quickly into new areas and potentially become tomorrow's global leaders.

UK smaller companies are typically listed in the FTSE 250 index (the smallest here are capitalised at around £400 million) and FTSE Small-Cap index (roughly the bottom 2% of the FTSE All-Share by value), the FTSE Fledgling Index (those listed on the main market, but too small for the FTSE All-Share) and the constituents of the Alternative Investment Market (AIM).

These indices are more domestically focused, as they include fewer global companies than the FTSE 100. For example, they contain familiar names such as , , , and Mr Kipling cakes maker .

As with most retailers and housebuilders, these companies tend to have greater exposure to their domestic economies. As a result, they can be vulnerable to the potential for economic downturns, as they are likely to have less spare cash on their balance sheets to deal with difficult times, compared to their larger counterparts and this could impact on the appeal to investors.

The uncertainty over Brexit is also affecting smaller companies. The UK is set to leave the European Union on 29 March 2019.

The IMF has recently downgraded its outlook for UK growth for 2019, while the rest of the G7 has been upgraded on the back of a strengthening global economy. In its latest forecast, the IMF projects growth for Britain of 1.5% down from 1.6%. The IMF's UK forecast for 2018 is unchanged at 1.8%.

However, corporate earnings growth has been much stronger than large-caps boosted by rebound in the sterling.

Small-caps are still trading on around a 10% discount to larger companies and generally have lower levels of debt, which offers some protection. The FTSE Small-Cap index is currently trading on a price/earnings (PE) ratio of 11.20 compared with the FTSE All-Share on 20.35 times.

Investors seeking exposure to smaller companies may want to consider smaller companies funds, holding a wide range of companies across different sectors with the expertise of a fund manager to pick stocks. Here is a selection of funds and trusts which focus on high-quality companies - those with good management who deploy capital effectively to drive sustainable earnings growth.

High-quality smaller companies funds include:

- invests in a portfolio of UK smaller companies with intellectual property that will enable them to deliver sustained above average profitability.

- "a fund for all seasons" that invests in high-quality companies with strong earnings growth potential.

- invests high-quality smaller companies with sustainable earnings that can outperform in all economic conditions.

- invests in companies with a market cap below £250 million that are expected to benefit from changing consumer trends: they are leaders in niche markets or possess disruptive technology.

The attractiveness of smaller companies for investors extends to other countries. To capture this growth, investors can consider funds that invest in the US, Europe, Asia or globally.

Investors should be aware that some of the larger open-ended funds in the sector have to manage liquidity. These funds need to hold cash positions to meet redemptions or to manage large inflows, so might move up the cap scale. If they find their size is restricting ideas they may soft close their funds for a limited period.

In contrust, due to their closed-end structure, investment trusts can be fully invested without any concerns over liquidity, and so tend to have less cash drag on performance. Investment trusts do not need to carry immediate liquidity in their portfolios to meet investor redemptions.

High-quality smaller companies trusts include:

- invests in companies with sustainable growth characteristics and can take both long and short positions through CDFs to enhance overall performance.

- invests in high-quality smaller companies with strong balance sheets, capable of self-help rather than being overly reliant on the wider economy to stimulate growth.

- focuses small and mid-cap quality growth stocks at the right price, often described as "quality at the right price".

- invests in "tomorrow's large companies today": small and mid-cap quality companies that are expand organically and operate within growth sectors.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.