Mark Mobius' replacement exits Franklin Templeton

2nd February 2018 12:33

by Tom Bailey from interactive investor

Share on

Emerging market investor Carlos Hardenberg has resigned from Franklin Templeton Investment Management.

Hardenberg, who managed Franklin Templeton's , is due to leave at the end of March. He will be succeeded by Chetan Sehgal, who works alongside Hardenberg.

Hardenberg took over as TEMIT's lead manager in October 2015, taking the reins from 30-year veteran emerging market investor Mark Mobius.

Hardenberg took over TEMIT after a period of poor performance for the trust. However, he managed to steady the ship and turnaround the trust's fortunes. Since Hardenberg took over the net asset value of the fund grew by 100.9%. In comparison, total return of the MSCI Emerging Market Index (measured in sterling) sat at 76.1% for the same period. TEMIT's share price has doubled over the period, from 404p to 815p.

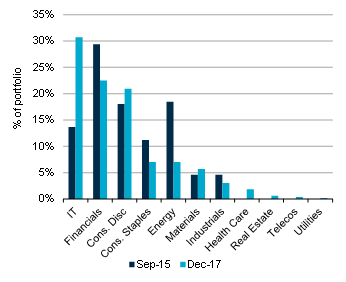

The upturn in performance was achieved by a major realignment of TEMIT's portfolio, with an increased focus on both China and technology stocks. Before Hardenberg took over, TEMIT's weighting of technology stocks was just 6 % - it now stands at 31%.

The trust now has significant holdings in Asian technology firms, including Chinese tech giants (4%) and (3.4%). It also holds 8.1% in South Korea's Samsung Electronics.

At the same time the trust reduced its holdings in both energy and financials.

Source: Company & Numis Securities Research

There is not expected to be a major change in the strategy or investment style following Hardenberg's departure.

As TEMIT Chairman, Paul Manduca, noted, Hardenberg's successor already plays a prominent role, noting Sehgal has been "directing Templeton's global emerging markets strategy since October 2015."

Sehgal joined Franklin Templeton in 1995 and is a senior managing director as well as the director of portfolio management for global emerging markets and small cap strategies.

Stockbroker Numis Securities also noted that there will be "no significant change in investment approach given that Carlos and Chetan worked closely together, and they have been jointly managing a number of portfolios."

"The similarity in approach is highlighted by TEMIT having over a 90% portfolio overlap with Templeton Developing Markets, a $1.7 billion US listed fund, for which Chetan is lead manager."

The brokers, however, did caution: "We have been impressed by Carlos Hardenberg and his track record has been impressive since taking over TEMIT. As a result, the change in management inevitably raises some concerns."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.