Earn a £10,000 annual income from investment trusts in 2018

9th February 2018 17:12

by Helen Pridham from interactive investor

Share on

Finding a way of using your capital to provide a sustainable income, typically when you reach retirement, is becoming increasingly important.

A growing number of retirees are opting for pension freedom, rather than buying an annuity or taking a company pension, and are looking to invest and draw down their lump sum.

An investment trust portfolio that provides a regular income as well as potentially protecting the value of your capital could be a valuable part of the solution.

Many investors are understandably wary of investing in the stockmarket when they retire, because of the volatility of share prices, but company dividends usually follow a more predictable path and generally tend to increase over time as company profits grow.

The added advantage of investment trusts is that they can keep some of their dividend income in reserve, rather than paying it all out immediately as open-ended investment funds (OEICS) must do.

This enables them to smooth out income payments to investors. A growing list of trusts is showing how it's done by clocking up 10 or more years of consistently increasing dividend payments.

Another advantage for investment trusts, following a rule change in 2012, is that they are also allowed to dip into their capital gains to boost their dividends.

This can provide income investors with a good way of gaining exposure to trusts which make most of their profits from capital growth, without having to cash in any shares themselves in order to generate the income they need.

Practising what we preach

To illustrate how an investment trust income portfolio can work in practice, our sister website Money Observer has put together a portfolio designed to deliver an annual income of £10,000 based on current yields.

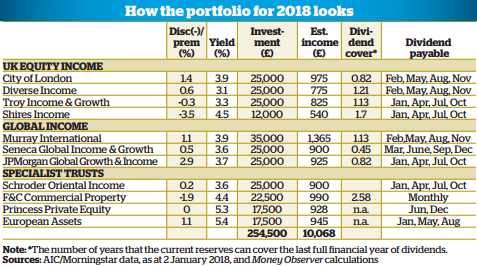

This year, we have calculated that the initial investment required to deliver this income is £254,500.

It would be possible to achieve the same amount of income with a smaller lump sum, but this would mean investing in more specialist, higher-yielding trusts, or in trusts trading on higher premiums to net asset value, which could increase the risk of capital loss.

The portfolio we have suggested is more broadly based. It is not without risk, of course, and investors should be prepared for both capital and income fluctuations.

This is the fourth year we have suggested such a portfolio and we have modified it slightly each year to make it relevant for new investors.

Each year it has met its income target but in the first year - 2015 - there was a small capital loss in the portfolio. However, this reduction was more than made up by the growth the portfolio generated in 2016 and 2017.

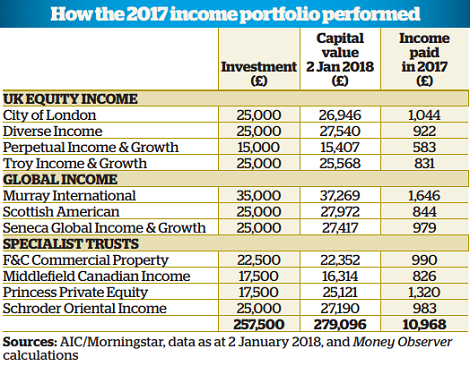

Last year, the capital outlay of £257,500 for new investors in the income portfolio grew to £279,096. The income generated from the 11 trusts was nearly 10% above our target, at £10,968.

So, for investors who backed this portfolio strategy last year, the enhanced capital sum at the end of the period should provide an income that more than beats inflation, which is one of the chief goals of this portfolio.

A tweak to our UK exposure

Around a third of the portfolio last year was held in four UK-focused equity income trusts, and this level of exposure will be maintained in 2018 to avoid taking too much currency risk. Though this aspect of overseas exposure can work in investors' favour, as it has done in previous years when sterling has weakened, it cannot be guaranteed.

All four holdings paid out more income than we had estimated and their capital values also rose by varying degrees. clocked up its 51st consecutive year of dividend increases and it still has money in reserve.

The strongest performer on both the income and capital fronts was , which invests in small as well as large companies, including those listed on the Alternative Investment Market (AIM).

Its capital value increased by 10% and its income payout by over 20%. This included a special dividend to reflect the special dividends that the trust received from many of the companies in its portfolio.

also paid a special dividend, but this was slightly down on the special dividend it paid the year before, although its basic dividend increased.

However, we have been disappointed by the performance of the trust over the past two years. Last year we reduced our holding in it, hoping that its performance would improve, as we still believe Mark Barnett is a good manager for the long term.

However, we are concerned that he may have taken his eye off the ball somewhat due to his role as head of UK equities at Invesco Perpetual.

We have decided to replace this holding this year with , which has the attraction of a higher yield.

It invests principally in UK equities but also in fixed income securities. That mixed asset approach will help to give this part of the portfolio extra diversification, which may be useful in case of UK market volatility post-Brexit.

A replacement in the global category

All three of our global equity income holdings delivered capital growth and paid out as much or more than the expected amount of income in 2017.

remains the portfolio's largest holding. If anything, its high exposure to Asia and the emerging markets at just over 40% of its portfolio now makes it an even more relevant holding for the coming year, with the outlook for these areas becoming increasingly attractive.

, to which the allocation was increased last year, was the star global performer in capital terms, up 12%, though the rise in its income payment was modest at less than 2%. However, the good performance of this trust in recent years under manager Dominic Neary has resulted in the trust trading at significant premiums to net asset value.

Bearing this in mind, as well as the departure of Neary last August, we have decided to replace this holding with .

Among the attractions of JPMorgan Global Growth & Income are its higher yield and also the fact that it has a lower exposure to the UK than Scottish American. Its UK holdings are currently under 10% of the portfolio.

At the end of 2016, the trust's shareholders agreed that future dividends could be funded using capital as well as income, and it was decided that a target dividend equivalent to at least 4% of the net asset value (as at the end of the preceding financial year) would be paid.

As its investment approach is focused on growth and its NAV performance in recent years has been strong relative to its peers, we feel the risk of capital erosion from this dividend policy is minimal.

New specialist

For added diversity, 30% of our portfolio is invested in four specialist trusts to give exposure to higher-yielding options or those we believe have good prospects for growth. Performance here was mixed in 2017.

delivered a steady monthly income but declined slightly in capital terms, mainly because the share price fell to a small discount to net asset value at the end of 2017, having been quoted on a premium for most of the year.

was one of our best performers in terms of increased income and capital growth, as Asian stockmarkets benefited from the recovery in global economic growth and the earnings of Asian companies rose, underpinning healthy dividend growth. This is a trend that we expect to continue.

Our overall star performer in capital growth terms was , which invests in a globally diversified portfolio of unquoted, mid-sized private companies.

This was partly due to the strength of its underlying investments but also to a narrowing in the trust's share price discount to net asset value over the year, from 13.1% to zero. Private equity trusts were a popular choice among investors last year.

The portfolio's least successful holding was , which delivered slightly less income than we had expected and also saw a fall in its capital value. Although the trust still offers an attractive yield, we have decided for this year's portfolio to switch to another trust with a higher yield which we believe has more potential.

The new trust is , which fixes its dividend at 6% based on its net asset value on 31 December each year. The dividend is paid mainly out of capital reserves but what we like about this trust is that it invests in smaller companies across Europe and these companies do not tend to be high dividend payers because they are growth businesses.

It means that we can give the portfolio exposure to an area that is not typically present in income portfolios and which we believe has the potential to perform well this year.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.