How a shares ISA can make you a millionaire

9th February 2018 16:51

by Dzmitry Lipski from interactive investor

Share on

Maximise returns with an ISA

There are now less than two months before the end of the tax year, which means if you haven't used your ISA allowance yet, you need to get moving. You can invest up to £20,000 in your ISA until 5th April this year and the same amount next tax year. As your annual ISA allowance is individual, together you and your partner have a £40,000 allowance of tax-efficient investing.

Additionally, you can invest for your child with a Junior ISA up to £4,080 this year and £4,128 next tax year. Much like an ISA, a JISA lets you invest in funds, shares, investment trusts and exchange traded funds (ETFs).

Over the last 30 years, the government has regularly increased the annual ISA allowance from £2,400 in 1987 – the PEP allowance - to its current level. In April 1999, Chancellor Gordon Brown introduced ISA's to replace PEPs with a limit of £7,000. In the March 2016 Budget, Chancellor George Osborne made surprise ISA changes with a view "put the next generation first". The ISA investment limit was increased from £15,240 to £20,000 from April 2017, and the new Lifetime ISA was launched for adults under the age of 40, with a maximum contribution of £4,000 a year and a 25% bonus.

The Lifetime ISA limit counts towards your annual ISA limit. Funds put into this account can be saved until you are over 60 and used as retirement income, or you can withdraw it to help buy your first home.

Investments held within an ISA do not incur capital gains tax (CGT) when sold, and no further tax is payable on any income or interest paid. This means investments within an ISA can grow more than if held outside this tax wrapper. It is, therefore, sensible to put as much as you can into your ISA each tax year to maximise your returns.

Unlike with pensions, there is no lifetime limit for ISA and you do not pay tax as you take out your money, making it a great vehicle from which to draw retirement income without waiting until you're 55.

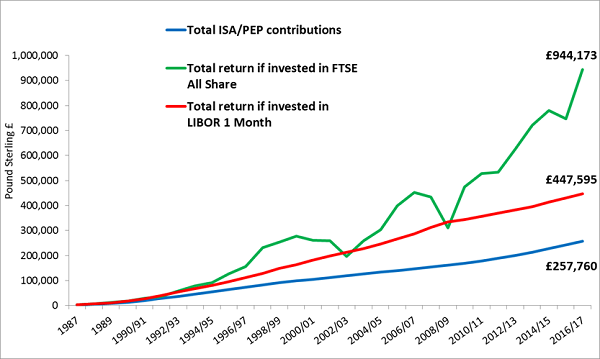

You could hold cash in an ISA, although you would probably get much better long-term returns if you invest your funds in the stockmarket. The incredible chart below demonstrates the wonderful benefits of compounding; how an investor would have grown their assets over time if they had invested the full ISA allowance since 1987.

A total ISA contribution of £257,760 over the past 30 years, reinvested on 6 April each year into the , would have delivered an almost fourfold return of £944,173 as at 5 April 2017. When you factor in interest compounded over the period (red line on the chart), equities still return over twice as much as cash.

Source: ISACO, Morningstar Direct and interactive investor (past performance is not a guide to future performance).

Interesting to note on the chart above is how the gap grew more rapidly than ever following the Credit Crunch; record low interest rates and a phenomenal recovery in equity markets, even before pro-business Donald Trump's election victory, supercharged stocks' outperformance.

Interest rates will rise, but probably only slowly. Equity markets have become more volatile recently, and, at the very best, their upward momentum has slowed. But investing in shares will almost certainly continue to outperform cash over the long term.

With an interactive investor ISA you can save as little as £25 a month into your ISA and choose where you invest using the ii Rated Investments list of over 250 funds, investment trusts and ETFs.

So, whether you're an adventurous, pro-growth optimist; a pessimist in fear of market correction; or an investor who wants to be prepared for any eventuality, there are plenty of options.

For even more investment ideas, here are our best fund ideas for 2018.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation, and is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.