A beginner's guide: How to become an ISA millionaire

14th February 2018 11:27

Saving and investing enough money to become a millionaire is quite an achievement. But these days, thanks to individual saving accounts, it is possible to build up £1 million over less time because there is no tax to pay on income or capital gains.

The ISA was introduced in 1999 when it replaced the share-focused Personal Equity Plan (PEP), which had been around since 1987, and the cash-focused Tax Exempt Special Savings Account (TESSA).

It started life as a £7,000 allowance for stocks and shares, of which up to £3,000 could be used for cash; it rose above £10,000 in 2010, and in April 2017, the new ISA allowance went up to £20,000 per year.

The number of ISA millionaires is estimated to be up to 1,000 people, though the exact figure has not been revealed.

- Learn with ii: How to become an ISA millionaire | ISA Investment Ideas | Top ISA Funds

However, that number is set to increase in the future. That's because the value of ISA allowances has been going up and there has been a nine-year global bull market run.

As a result, the time needed to accumulate that first million has never been shorter for those investors fortunate enough to be able to put away their full allowance.

How long does it take?

In this feature we'll consider how long it would have taken an investor starting in the depths of the financial crisis in 2008 to become an ISA millionaire, and how long it could take now, assuming no further changes to annual allowances.

Becoming an ISA millionaire requires a combination of dedicated saving habits and decent investment returns. So how should would-be millionaires structure and manage their portfolio in order to reach their goal? And how can they balance the search for growth with capital preservation?

Ben Yearsley, director at Shore Financial Planning, has calculated that for investors starting now, investing £20,000 a year and assuming growth of 7% each year (after charges), it will take 22 years to become an ISA millionaire. "You will have a pot of £1.04 million at the end," he adds.

If we assume an 8% growth rate, that will knock almost two years off the total time needed and save £40,000 worth of contributions in the process. And a 10% investment growth rate will reduce the time needed to just 18 years and save another £40,000. However, Yearsley argues, it's better to be realistic, use the 7% figure and allow 22 years.

"The simple truth is that the higher the growth rate, the quicker you will reach the magic target and the less money you will have to invest to get there," says Yearsley.

"However, that doesn't mean you should have a portfolio all pointed the same way; you do need a balance of styles, sectors and countries in your portfolio to even out risk."

He adds that if your target is long-term growth, then it would be worth avoiding bonds and sticking predominantly, if not exclusively, to equities.

Research, set and rebalance

Yearsley says: "Spend the time researching the best investments prior to investing, then generally don't touch the portfolio, except maybe to do a bit of rebalancing each year. You don't want the entire portfolio performing in the same way at the same time (i.e. going up and down in synchrony). If it does that, you may as well just buy one fund. As long as you know why you've bought a fund and what its aim is, you can sit and be patient if it does lag behind."

For someone who started out in the depths of the 2008 financial crisis, it would have taken slightly longer to become an ISA millionaire.

Yearsley has crunched the numbers for someone who invested the full ISA allowance on 1 January each year, starting in 2008. He calculates that in total, they will have invested £110,560 so far, which will have grown to £173,159 if invested in the (figures to 21 December 2017).

From the present time onwards, he assumes the fund grows by 7% per year and the full ISA allowance is invested each year, so 1 January 2018 sees an investment of £20,000.

He concludes that from here on it will take 15 years of ISA allowance invested, which equals another £300,000, bringing the total investment to £410,560.

"Assuming 7% growth, by 1 January 2033 you will have a pot worth £1,015,512," says Yearsley. It would therefore take 25 years to become a millionaire in this scenario. Andrew Craig, the author of How to Own the World and founder of the website Plain English Finance, agrees that 'slow and steady' is one way of becoming an ISA millionaire. The other possibility is to be "extremely lucky, or extremely clever, with a far more aggressive approach", he argues.

This would involve adopting more of a 'trader' approach in your ISA account and turning your portfolio over, cutting losers and running winners.

"One version of this approach is to seek out a few small companies and hope that one or more of them is a "ten-bagger" [an investment that returns more than 10 times your initial capital] or better," says Craig.

"These are actually more common than many people think. They can be found in sectors such as tech and biotech, but also in far more sober-seeming sectors - just look at or as examples of companies playing in perfectly normal and understandable sectors of the economy that have made investors wonderful returns in recent years."

He argues that for those who are going to try to play this stock-picking game, "it is imperative to arm yourself with the necessary valuation skills, become a voracious reader and really try to think with an investor's hat on when you move through the world".

He also suggests that you should put together your own well-thought-out checklist of things a company needs to have before you make an investment.

"This is certainly what many of the best small-cap fund managers do, and some of them have made stellar returns."

Smaller company potency

To illustrate the potency of smaller companies, Craig cites an academic paper by London Business School professors Elory Dimson and Paul Marsh about small-cap returns. They found that since 1955, the Numis Smaller Companies index (NSCI), which measures the performance of smaller quoted UK companies, has achieved an annualised return of 15.1%.

That's 3.4% more a year than the FTSE All-Share index. A £1 investment in the NSCI made at its starting point in 1955 would be worth £6,067 by the end of 2016. This compares to £968 if £1 had been invested in the FTSE All-Share over the same period.

Investing in smaller companies is in fact the favoured strategy of Britain's self-declared first ISA millionaire.

In 2003, John Lee became the first person to come out to the press as an ISA millionaire in the UK. Previously a minister in Margaret Thatcher's government in the 1980s, he is now Lord Lee of Trafford and a Liberal Democrat.

He became an ISA millionaire by investing the maximum amount that could be put into ISAs and their predecessors, Peps, each year, and reinvesting the dividends.

He says: "In 1987, when Nigel Lawson introduced the Pep, I recognised the tax-free savings opportunity."

He says the initial problem was that he couldn't find an investment manager who would allow him to choose his own stocks rather than opting for a ready-made portfolio, "and I always wanted to select my own stocks".

He likes companies with strong brands and conservative management, favouring companies run or started by families.

He looks for businesses with low levels of debt and high levels of cash. It is important that they continuously increase their dividends, because dividends tell us that "the company has got the cash to pay"; it is also an "indication of what the board directors think will be a dividend they can pay the following year, as most companies sensibly think ahead and don't want to cut the dividend". And finally, the dividend yield "provides another prop to the share price".

Lord Lee continues: "I'm not an early-stage investor. I don't back start-ups, but go for businesses which are already established, already profitable and already paying dividends; they can be AIM stocks, but not what I call hope-and-pray stocks."

His preferred kind of company has moved from the main market across to the AIM market. Another important consideration for him is that the directors need to have 'skin in the game', investing personally in the stock they are running.

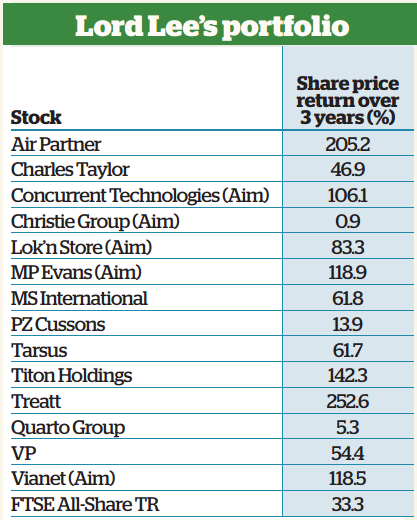

Lord Lee's AIM holdings include , which provides professional services such as surveying to businesses, , which provides self-storage space for businesses, and , a firm that makes natural feeding additives for pigs and poultry. Also in his ISA is , which provides monitoring systems to track beer consumption for pubs.

Another stock he holds is , a supplier of flavour, fragrance and cosmetics ingredients, based in Bury St Edmunds. Treatt represents one third of the value of his ISA: "I believe in holding good shares and not taking profits," he says.

When Lord Lee declared that he had £1 million in his ISA, he says he had invested about £126,000 of original investment into the wrapper to achieve £1 million through capital growth and dividend reinvestment.

Growth and capital preservation

When asked about whether he looks for growth or capital preservation, Lord Lee says: "I always believe you can achieve both. The key is buying at the right time at a modest valuation."

His best year in terms of investment return was 2003, with 44% capital performance, and his worst year was 2008 when the financial crisis hit and he lost 42% of his portfolio value.

"But during that period I bought a lot," he adds; and when the market rebounded in 2009, his portfolio appreciated by 28%, with a further 29% uplift in 2010.

Something he does now, which he says he should have done earlier, is to operate a 20% stop-loss order, which limits the extent of falls before a holding is sold.

"Face up to poor decisions and apply a 20% stop-loss; there's nothing worse than keeping a loss-maker in your portfolio."

He explains that what's worse than the financial loss is the fact that keeping losers is "bad for your morale, because every time you look at your portfolio or hear the name of the company it draws blood and sucks away confidence".

However, he recommends letting profitable companies have their run.

He adds: "Understand what the company does, and ignore minor price movements."

He also recommends looking for optimism in the company chairman's comments. And finally, he advises: "Don't worry too much about the macro outlook, about North Korea or Trump. Focus on a particular company, and be prepared to hold it for at least five years. Don't chop and change your portfolio - don't treat the stockmarket like a casino."

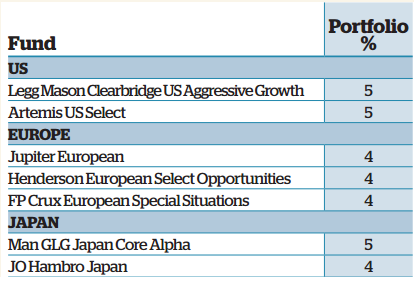

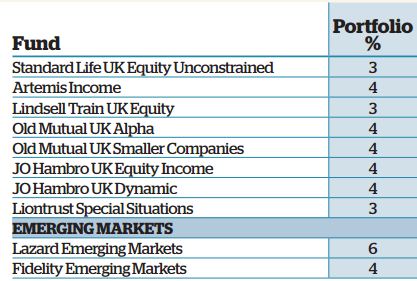

An adventurous fund portfolio for would-be millionaires

Ben Yearsley says: "Without selecting funds specifically for capital preservation, I have included complementary funds in the portfolio that have different characteristics. For example, the is nowhere near as racy as say . However, over time it should deliver excellent returns, but in a lower-risk manner, as the underlying investments are typically key assets that have to be used and the underlying income they provide is often inflation-linked."

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks