Should you chase this 8% yield?

13th February 2018 12:08

by Kyle Caldwell from interactive investor

Share on

Dividend investors had cause to celebrate in 2017, as dividend payments soared to their highest ever level, recording a year-on-year rise of 10.4%.

Another record-breaking year in 2018 looks unlikely, however, as one of the big drivers behind last year's boom - the resurgence of the mining sector - will no longer provide such a big boost.

The overall picture, though, remains healthy, with dividend growth expected to be helped by banks, which have put their balance sheets in order and are gradually upping dividend payments.

Overall, companies are expected to yield around the 4% mark in 2018, much higher than UK 10-year government bonds, which are yielding 1.6%. There are higher yields available among UK stocks, but care needs to be taken, as some will inevitably turn out to be 'value traps'.

In order to help investors spot a potential dividend disappoint in advance Money Observer has teamed up with wealth manager Canaccord Genuity to highlight dividend shares that may struggle to deliver on the dividend front.

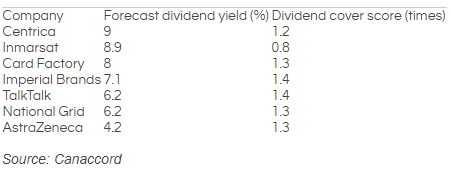

We asked Simon McGarry, a senior equity analyst at Canaccord, to create the dividend danger zone share screen. McGarry filtered through the 700-odd names in the and added the following filters: a market cap of over £200 million, a dividend yield of 4% (higher than the FTSE 100 average) and a dividend cover score of below 1.4 times. Two other filters were also applied: the first filtered out companies that appear in a financially sound position to pay off their debts, while the second excluded firms where earnings have been upgraded by analysts.

After factoring in all of the above, just seven shares remained at the start of February, highlighted in the table below. However, McGarry points out that none of these shares should be viewed as 'sell' recommendations. On the contrary, some of the shares that are potentially in dividend danger may actually pique the interest of contrarian investors who anticipate a share price recovery in due course.

When the screen was last run at the start of January six shares featured in the dividend danger zone table and they once again appear: , , , , and .

A new entrant to the table, , appears this time around. Earlier this month the pharmaceutical giant reported that total revenues and product sales declined in 2017, by 2% and 5% respectively. Moreover, last summer the firm suffered a major setback in one of its drug trails, which rocked its share price. Management recently reiterated the firm's commitment to the dividend and it has indeed been a reliable payer over the past decade, but our screen indicates some doubts.

Stock in focus: Card Factory

Card Factory, founded by a husband and wife team in 1997, set out to undercut other card stores. Two decades later low prices remain for both cards and gifts across its 913 stores in the UK.

In 2010 the founders sold the business to Charterhouse Capital Partners, which in 2014 listed the company on the London Stock Exchange, at 225p a share. Investors who bought in, however, won't be sending a thank-you card, as the share price has dipped to just under 200p.

There have been two profit warnings of late, brought about by the weakness in the pound following the Brexit vote. For the most part of 2017 and indeed so far this year the pound has been gaining ground on both the US dollar and the euro, so in theory cost headwinds from more expensive imports should ease. But, according to McGarry, there are other risks to the 8% yield.

"About one-third of the cards sold are handcrafted. These cards struggle to compete against cheaper Asian (mostly Chinese) rivals. In addition, the cost base is higher relative to other UK retailers, reflecting the fact that they sell low-value merchandise from small high-street stores. Thirdly, the shareholder register is unusually concentrated, with over a third of shares held by just two institutional investors," he says.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.