Hidden gem investment trusts for your ISA

16th February 2018 12:35

by Fiona Hamilton from interactive investor

Share on

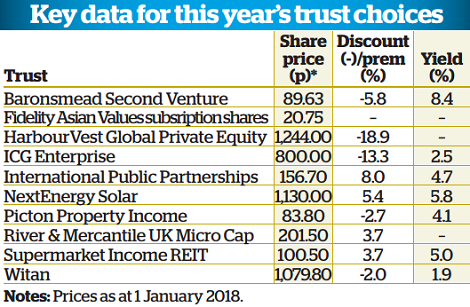

Our annual niche investment trust selections focus on areas that are best accessed through investment trusts or other forms of closed-ended funds.

This applies where the sectors in which they invest are relatively illiquid, such as the commercial property, unquoted companies and infrastructure sectors. However, the appeal of these trusts may derive from their board's commitment to a long-term approach, as is the case with family-controlled trusts, or they may benefit from special tax treatment, as with venture capital trusts.

Individual investors have different priorities. Young contributors to a pension, for example, are likely to favour long-term returns, whereas retirees are likely to be more interested in income than capital growth. We have therefore divided our selections according to the investment goals they satisfy.

Most of our picks focus on unquoted or non-equity asset classes. They should be complementary to the conservative and adventurous equity picks that we update each quarter. In some cases, they should perform relatively well if equities plunge into a bear market.

Last year's addition of a trust focusing on micro-cap companies has proved very rewarding, producing gains of more than 60%, but our peer-to-peer lending specialist selection has again proved very disappointing. We have therefore dropped this category.

Selections for long-term total returns:

Family-controlled trust

The attraction of family-controlled trusts is their multi-generational approach, which typically involves investing for the long term, guarding against downside risks, controlling costs and targeting a progressive dividend to keep the wider family happy.

ticks all these boxes, and having substantially outperformed the MSCI World index over the past 12 months and raised its dividend by 11.8%, it is again our selection.

The Henderson family, which founded Witan in 1909, still has a sizeable stake. Harry Henderson, who chairs Witan's board, has a personal shareholding worth around £8 million. Most of the trust's globally diversified equity portfolio is subcontracted to 10 hard-to-access third-party managers. Its overall performance has sharpened up considerably since Andrew Bell became chief executive in 2010.

Bell is in charge of manager selection, asset allocation and gearing. He makes a point of backing investment managers with a variety of styles and specialisms, which helps reduce volatility. He is also responsible for investing up to 10% of assets in a portfolio of specialist funds, which have generally enhanced returns.

In the course of 2017 Bell added an emerging markets specialist to the roster, increased European exposure through the appointment of two new high-conviction managers and cut back from five to three global managers. These measures helped reduce exposure to the UK and boosted the portfolio's active share (the degree to which it deviates from its benchmark) to around 75%.

Its ongoing charges figure of 0.65% is competitive, and gearing of 11% indicates cautious optimism.

Micro-cap trust

had a great 2017, substantially outperforming all its peers at the net asset value (NAV) level, which has been rewarded with a premium rating for its shares.

The trust focuses on companies capitalised at less than £100 million, which manager Philip Rodrigs (who is no longer the fund manager please see below*) believes can be particularly rewarding because their illiquidity and lack of analyst coverage deters many investors. Accessing them through a closed-ended fund means he does not have to worry about investors' money flowing in and out.

Over its first three years, RMMC's NAV returns have been almost twice those of the benchmark Numis Smaller Companies Plus AIM index. The portfolio comprises just 39 holdings, with technology-related companies accounting for more than a quarter of invested assets. Last year's gains were powered mainly by companies specialising in digitisation and 'big data', such as , and .

To ensure RMMC can remain tightly focused without taking unduly large stakes in investee companies, the board is entitled to buy back shares at NAV if the trust's total assets exceed £100 million, and it did so in July and December. With interest rates and inflation rising, and UK consumers' discretionary incomes under pressure, Rodrigs says: "This remains a difficult environment for firms without a strong market position, hence the continued focus on investments with unique characteristics."

- This piece was originally written in January for Money Observer's February magazine. Since the print publication Philip Rodrigs, manager of River & Mercantile UK Micro Cap Trust (RMMC), has left the business following an investigation into a professional conduct issue, which was unrelated to Rodrigs' portfolio management responsibilities.

Fund of funds private equity trust

Our ongoing support for is predicated on the belief that the US economy has plenty of momentum and that the dollar is unlikely to depreciate much against sterling over the next year or so. Both factors are important, first because HVPE's US exposure is currently in line with its longterm target of 65%, which is the highest in the private equity fund-of-funds sector. Secondly, as the trust's chairman, Sir Michael Bunbury, points out: "Many assets located outside the US are heavily influenced by the performance of the dollar."

Dollar weakness affected the trust's sterling-denominated share price returns in 2017, but they were nonetheless among the best in the private equity sector over the past five years, supported by the best NAV total returns.

Longer term, Numis Securities reckons that HVPE's NAV total returns outperformed the MSCI World index by an average of 2.6% a year over the 10 years following the trust's December 2007 launch, despite a very tough start.

This can be attributed to the trust's commitment to maintaining a relatively steady flow of new and secondary investments throughout the business cycle, though it has been cautious recently, due to the high prices being demanded. The quid pro quo is that realisations have been at an average of 30% above carrying value.

Bunbury warns that "the world looks increasingly unpredictable". But the US economy has defied the doomsayers so far, and if it does run into trouble, the trust believes the recent extension of its substantial credit facilities leaves its balance sheet "positioned to withstand any unforeseen shocks".

Total Return with an attractive income:

General property trust

Michael Morris and his team have continued to achieve comfortably above-average returns for , the management of which they are exclusively committed to.

UK office and industrial assets account for 36 and 40% respectively of PCTN's portfolio, and both have made the most of occupational demand and rental growth in London and the provinces. Retail warehouses account for 10% of assets. Just 12% is invested in high street properties, split between the south east and the rest of the UK.

Overall occupancy was up to 95% prior to the August acquisition of a substantial office block in Bristol, which had been fully refurbished but was only 70% let. Its purchase, partially financed by the sale of several smaller properties, continues PCTN's move towards fewer but larger properties.

Morris is excited about the potential returns from active management of this investment. The portfolio's weighted average unexpired lease term is 5.3 years, which Morris views positively as offering potential for active management.

Picton's yield is on the low side for its sector, but it is unusually well covered by reserves. The good news is that the total dividend is being raised to 3.5p for 2017/18, and there could be a further rise in 2019 if plans to convert to a UK Reit come to fruition. This should help boost the shares' rating.

Specialist property trust

, which made its debut in 2017, is our new specialist property pick. It invests in freehold and longleasehold properties that are fully let to the largest supermarket operators with annual, upward-only, index-linked rental uplifts (collared at 0% and capped at 4-5%).

Assets must be in highly populated residential areas with good transport links, and their operators must already be fulfilling "the last mile of grocery home delivery and/or click and collect".

SUPR is managed by Steve Windsor and Ben Green at Altrato Capital, which has structured and executed more than £3.5 billion of supermarket property sale and leasebacks over the past decade. They believe supermarket property prices have bottomed out following a price war, and they are backing their judgement with holdings in the trust of 1 million and 900,000 shares respectively.

When considering purchases, they target an average unexpired lease term of at least 15 years until the first break clause. They favour properties that offer potential for short-term capital growth through active management -by installing green energy technology, for example - as well as long-term scope for a change of use, into residential properties, for instance.

The fund is targeting annual total returns of 7-10% over the medium term, and it is committed to providing a stable, longterm, inflation-protected income, and to an initial target yield of 5.5%.

Direct/fund of funds private equity trust

, formerly known as Graphite Enterprise Trust, has exhibited a new dynamism since its management was incorporated into Intermediate Capital Group in early 2016. Thanks to the support of ICG's large and globally oriented private equity team, ongoing manager Emma Osborne has been able to identify more opportunities for both direct and fundbased investments.

ICGT's new investments exceeded its realisations for the first time in six years in 2016/17. With US exposure up to 23% and UK exposure down to 37%, the portfolio looks better placed to weather a difficult period for the UK economy.

The trust has continued its strategy of investing mainly in established and profitable medium-sized private companies in developed markets through a combination of in-house and third-party managed funds, and direct investment. However, the mix has changed. High-conviction direct investments, co-investments and investments in ICG-managed funds have increased to more than 40% of the portfolio - with a target of 50-60% over three to five years. Meanwhile, costs are falling because more assets are being managed in-house and ICG has taken over non-investment functions.

Operating improvements and strategic changes are contributing to strong profit growth for the trust's 30 largest underlying investments, which account for 45% of assets. Meanwhile, average uplifts to carrying value of 36% on recent realisations indicate a conservatively valued portfolio.

ICGT looks good value within its sector, especially as the board's decision to start paying dividends of at least 20p a year gives a projected yield of 2.5%.

Income with limited capital growth prospects:

Social infrastructure trust

Talk of nationalisation during the autumn 2017 Labour Party conference sparked a fall in ratings across the listed social infrastructure sector. Shares in were not immune. However, the company's relatively limited exposure to 'classic' PFI deals and its lack of exposure to UK hospitals helped it hold up comparatively well. Indeed, its December fundraising was oversubscribed at 150p, the same price as in its much larger fundraising seven months earlier.

INPP's dividends have increased by 2.5% a year since launch and are forecast to rise from 6.82p to 7p in 2018, implying a yield of 4.6%. Its attractions include the 36-year weighted average investment life of its projects, which is high for the sector, and the inflation linkage of its investment returns, which is also high at 83%.

It holds more than 10% of its assets in construction, mainly in the Thames Tideway Tunnel, which offers scope for capital appreciation. Importantly, income from its investments is mainly based on asset availability or regulated assets, whereas some of its peers have more exposure to demandbased returns. INPP's largest sectoral exposure is to energy transmission, which is paid on an availability basis over 20 years and fully linked to UK inflation.

The managers have suggested that market transaction evidence and the rise in UK inflation should boost the trust's end-of-year NAV, which was last recalculated at the end of June. INPP's shares held up relatively well in the 2008 financial crisis, and their low correlation with equities will hopefully stand it in good stead if equities suffer another major correction.

Renewable energy trust

keeps its place as our renewable energy specialist, because its assets have been sufficiently well managed to regularly generate above-budget returns and its costs are falling as it increases in size. It has achieved a NAV total return since launch of more than 7%, despite disappointing energy prices, and its steadily growing dividend is reasonably well covered for the sector.

Launched in 2014, NESF has grown into the largest solar-only renewable energy fund. Its managers would like to expand further and extend the trust's life, but they are wary about the prices demanded for large-scale UK assets in the secondary market, which is the main source of deals.

Instead, they have focused on some smaller and less aggressively priced UK solar assets, broken new ground by investing in eight sizeable operational solar plants in Italy, and acquired the rights to four subsidy-free UK projects expected to be built over the next year.

The Italian acquisitions account for 12% of assets, diversifying the portfolio both climatically and politically. The lion's share of revenue is expected to come from government-backed feed-in tariffs that run until 2031. Most of the foreign exchange risk has been hedged.

The venture into subsidy-free generation looks more daring, as it implies a reduction in the percentage of revenue backed by government sources. However, it looks as if this is the way the UK solar industry will have to go now that most forms of subsidy are being phased out. NESF's managers expect the subsidy-free plant to be costcompetitive with other energy sources.

Venture capital trust

Our niche selections include a VCT share, because a combination of factors enhance the income they offer to taxpayers. Yields tend to be high because many VCTs routinely distribute a mix of income and capital gains, while distributions and capital gains are tax-free, regardless of whether the VCT shares were bought at issue or in the secondary market.

To make the most of this scenario, we have picked a VCT that seems committed to paying a sustainable and attractive yield. has paid a dividend of at least 7.5p a share every year since 2007, and it is due to pay a final dividend of 4.5p for the year to the end-September in early February, having paid an early interim of 3.5p in March. With its shares priced at 90p, this gives a tax-free yield of 8.4%.

We like BMD because its portfolio is unusually varied for a generalist VCT. It has just 33% invested in 20 unquoted firms , 47% in 51 AIM-listed companies and 11% in the , which has had a strong run. The rest is mainly in liquid assets.

We also like the sector mix of 40% of investments in the technology and media sectors, and 27% in business services. More than 40% of the portfolio by value has been held for more than five years, and more than 30% for three to five years. With most investee companies reported to be trading favourably, there should be some rewarding realisations in the offing.

The managers have become sufficiently comfortable with recent regulatory changes to have made seven new investments last year and to seek new funds from investors.

Capital-only return:

Trust subscription shares

Subscription shares and warrants offer highly geared exposure to individual trusts over a specific period. They can therefore perform exceptionally well if the trust concerned does well within that period, but may expire worthless if it has a bad run.

This year's selection is the subscription shares of , which has performed strongly since Nitin Bajaj took charge in April 2015. This has been despite a disappointing run over the past year because of his value-oriented approach and deliberate avoidance of high-flying sectors such as the Chinese internet giants.

The subscription shares allow holders to buy shares in FAS at 381.8p on 30 November 2018 or at 392.8p a year later. With the subscription shares priced at 20.25p, they should prove a better investment than the ordinary shares if the latter's price increases by more than 4% by the end of November 2018 or 7% by November 2019.

This article was originally published in our sister magazine Money Observer. Click here to subscribe.

ii publishes information and ideas which are of interest to investors. Any recommendation made in this article is based on the views of the writer, which do not take into account your circumstances. This is not a personal recommendation. If you are in any doubt as to the action you should take, please consult an authorised investment adviser. ii do not, under any circumstances, accept liability for losses suffered by readers as a result of their investment decisions.

The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Members of ii staff may hold shares in companies included in these portfolios, which could create a conflict of interests. Any member of staff intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. We will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, staff involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.