Where our five fund experts are finding value

19th February 2018 12:02

by Marina Gerner from interactive investor

Share on

Whether the recent volatility in global equities is merely a blip or the end of the nine-year bull market is anyone's guess. But our multi-manager panel consists of expert long-term investors who seek value and diversification, and are unlikely to lose their focus in times of volatility.

We caught up with them recently to gauge their views on the best investments out there. Rather than building their portfolios by investing in individual stocks or bonds, our experts invest largely, or exclusively, in investment funds and trusts. This puts them in an excellent position to identify strong themes and winning managers.

Given the popularity of growth companies over the past year, particularly in the technology sector, our fund panellists note that this year could herald the return of value investing. The recent bout of market volatility will have thrown up further opportunities in that respect.

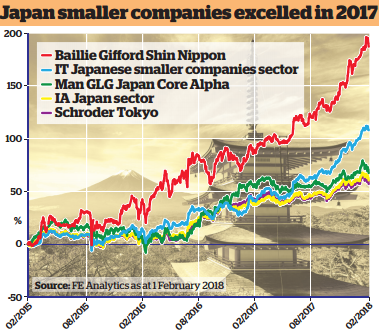

Our panellists are turning to global and well-diversified funds and trusts. Several look to Japan, which is a very attractive investment destination at the moment, as well as to the US and emerging markets. Others favour infrastructure funds that produce solid returns for income investors. Elsewhere, some of our multi-manager team have chosen a contrarian selection as their third fund pick

1) Jordan Sriharan, Thomas Miller Investments:

"Just 12 months ago, investors were overweight in cash; today it would appear most are overweight in equities," says our new recruit, Jordan Sriharan. "Risk sentiment has been very positive, with good economic reason, but how can an investor participate in any further rally while effectively managing their downside?"

He says one option is to take a value approach, for example via the . Its income orientation means it is overweight in financials, materials and the energy sector. "The US is quite late in the economic cycle and these more cyclical sectors should generate strong returns," he says. "Throw in tax reforms that will improve their earnings, and 2018 could herald the return of value stocks."

Sriharan adds that investors shouldn't ignore the defensive properties of this fund either. He points out that traditionally it has declined at a lesser rate when the S&P 500 is falling, so it should be well-placed should markets correct further.

As a further contrarian choice, he picks the , which has a track record going back to 1995. "Over both the short and long term, the fund has outperformed its benchmark - the Citigroup World Government Bond Index." He commends the fund's top-down, value-driven process.

His third pick is the , which takes a large-cap, contrarian and value-tilted approach. "The strategy has a great long-term track record. Since inception in 2006 it has outperformed the Russell Nomura Large Cap Value index by 81% and the TOPIX by 79%." Last year was a weak one for the fund, but Sriharan argues that the fund is well-placed to outperform in 2018.

2) Peter Walls, Unicorn Mastertrust:

"will celebrate its 150th anniversary this year. Few companies can lay claim to such longevity while remaining relevant in the world of finance," says Walls. He argues that investors seeking globally diversified equity exposure should look no further. While performance is "unlikely to shoot the lights out in any given year", long-term returns after costs should continue to compare favourably with the FTSE All World benchmark index.

The Brexit vote initially caused UK smaller companies to underperform bigger firms with international earnings. "Meanwhile, high-growth companies - particularly in the technology sector - have been the star performers, while value investing has largely been out of favour," says Walls. But as the gap between the two investment styles became more extreme, Walls' contrarian tendencies have drawn him to .

Walls' third pick is another Japan choice, , which has produced outstanding returns over many years - it returned more than 50% in 2017 alone. He says: "With its highly respected and experienced investment management team, it's no surprise this trust has captured the imagination of many new investors and allowed the company to expand through the issuance of new shares." Despite the recent correction, the shares trade at a premium of over 10%, however, so there may be better times to buy.

3) David Hambidge, Premier Asset Management:

Hambidge's fund picks are very different from each other, but they all aim for high income. His first pick is the , a UK smaller companies fund. It delivers "a much higher and more regular dividend than most other funds, and looks to generate long-term capital growth".

His second pick also falls into the out-of favour camp: "had a torrid time" last year, following a surprise cut in its dividend. However, Hambidge thinks the share price has factored in the bad news. He says: "In spite of the dividend cut (and because the price has fallen so much), the shares now yield more than 7%."

He says income-seekers might like the , which invests primarily in higher yielding global utility companies with a bias towards Europe. "The portfolio is designed to be less volatile than a more traditional global equity portfolio. It has underperformed of late because of political concerns and the possibility of higher bond yields." However, it could be argued that these risks are largely priced in, and a yield of around 4% is attractive compared with returns from global equities, bonds and cash.

4) Ayesha Akbar, Fidelity:

Japanese equities performed strongly last year, but the market remains attractively valued, as performance was driven by an improvement in earnings, according to Akbar. "I like the , which has a value tilt," she says. While value investing has broadly been out of favour since the financial crisis, she echoes Sriharan in her opinion that global growth should help to boost value stocks.

Her second fund choice is . This fund, run by Glen Finegan, has a relatively conservative investment style that targets companies with resilient business models. "While the fund will therefore lag in momentum-driven rallies, like that seen over the past year, it's an attractive long-term choice for access to emerging markets," Akbar says. "Emerging market equities are attractively valued compared with their developed market counterparts, and were relatively unscathed in the recent equity downturn on a one-year view."

Akbar's third choice is the , which like the Henderson fund has a low sensitivity to market wobbles. It screens global equity markets for firms with high returns on equity, low debt, strong balance sheets and good growth prospects. "Analysts then focus on areas such as profitability, financial control and competitive position," she says.

5) Peter Hewitt, F&C Investments:

Hewitt argues that the represents a different way to gain exposure to the wider technology sector. He says: "While it has some exposure to Europe and Asia, and around 20% in the US, more than 60% of the trust's holdings are in smaller UK companies." He adds that the exciting point is the breadth of opportunity among smaller technology firms in the UK. The trust trades on a 13% discount.

His second choice is , the largest pan-European property equity investment trust, which has just 7% exposed to direct property in the UK. Due to accelerating economic activity in Europe, Hewitt says, key cities are showing strong growth in rental values, and this fund is a good way to gain exposure. It "has an exceptional long-term track record of performance, as evidenced by 10-year dividend growth of 10% a year". The trust has a dividend yield of around 3%.

His contrarian selection is , which invests in early-stage growth biotechnology and healthcare firms. Its performance has been disappointing and it currently trades on a 10% discount. The trust is higher risk, but there is potential for significant reward if clinical trials are successful.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.