Dogs of the Footsie: Still outperforming?

28th February 2018 10:43

by David Budworth from interactive investor

Share on

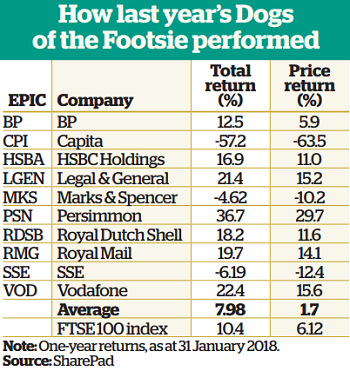

It could have been so different. If our Dogs hadn't included , the troubled outsourcer whose share price plummeted at the end of January after it issued a profits warning, we would be trumpeting yet another year of outperformance for the Dogs of the Footsie. Of course, Capita was in there, and the result was a disappointing year for our portfolio.

Overall, the portfolio produced a below-inflation return of 1.7% based on share price performance alone, and 8% when dividends are included. It failed to beat the , something that has happened in just five of the 17 years that Money Observer has been running the portfolio.

I know it is foolish to regret things that you can't change, but if we had not invested in Capita we would be talking about a healthy share price return of 8.95% and total return, including dividends, of a satisfying 15.2%.

So what can we learn from 2017's disappointment? First, that sometimes Dogs are unloved for good reason. A badly timed profits warning from just one of these companies can be the difference between investment success and failure.

More positively, the result shows that even a portfolio of just 10 companies provides sufficient diversification to limit the damage done.

The portfolio still finished the year in positive territory, though only just in price terms. Seven of the companies in the portfolio did better than the index in total return terms, and six in price terms, compensating for the laggards.

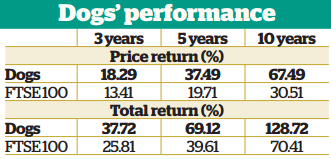

Even this year's performance was not poor enough to damage our Dogs' dominance over the index over the medium and longer term: the portfolio is still well ahead over three, five and 10 years , as well as over its 17-year life.

Anyone who had followed our Dogs strategy for the past 10 years would have more than doubled their money when dividends are included.

They would have made a 67% return, even if all the income had been spent. That is comfortably ahead of the FTSE 100 index , which has returned 30% in share price terms over the period and 70% on a total return basis.

The average annual return for our Dogs, including dividends, over the 17 years the portfolio has been running, has been a healthy 14%, compared with 6% from the index.

Sound strategy

Regular readers will be familiar with the basics of the Dogs strategy, which involves investing equal amounts in the 10 FTSE 100 shares with the highest dividend yields.

We simply select the 10 companies with the highest historic yields, based on past dividend payments - which can be obtained using a screening tool on interactive investor - and hold them for one year.

The logic behind the strategy is straightforward. Because investors are prone to be greedy when times are good and to panic when things go badly, share prices tend to overreact to positive and negative news.

A high dividend yield tends to indicate that a company is unloved, either because it has been through a bad patch or because it is in a sector that is out of favour. In such situations, its shares can often fall well below their fair value, and bounce back strongly when sentiment changes. Meanwhile, patient investors will be rewarded with generous dividends underpinning the high yield.

The bounce when sentiment turns positive can be highly profitable. That was certainly the case with 2017's top performer , up nearly 37% with dividends included.

This time last year, uncertainty over Brexit meant many investors had a negative view on housebuilders, including Persimmon. However, the housing market has proved more resilient than expected, as demand for newly built properties has been fuelled by affordable mortgages and government schemes to help people onto the housing ladder.

Dividends at risk

Of course, a high yield can also signal that a company is in trouble and that a dividend cut is on the cards. However, fear of reputational damage means managers will often move heaven and earth to avoid reducing a company's dividend.

Among our Dogs, the only company to announce a cut last year was Capita. It waited until 31 January, the last day of our portfolio's financial year, to deliver the bad news that it was suspending its dividend payments until further notice.

One of the rules when we select our Dogs is to exclude companies that have actually announced a dividend cut. The key word here is 'actually'. Companies are not excluded on the basis of forecasts or rumours.

This time last year was excluded from the portfolio on that basis. In the event, it slashed its dividend by 72% from 18p to 5p. It has been excluded again this year.

Even though the group is now targeting a 'sustainable and progressive dividend', this will be from a significantly lower base. Consequently, its dividend yield will fall sharply; it won't be a high-yielder for long.

Dividend cover clues

The world our Dogs prowl in is looking more challenging in 2018. The FTSE 100's dividend cover, a measure of how comfortably member companies can meet their dividend promises, is now lower than it was at the height of the 2008 financial crisis.

Ideally, dividend cover needs to be around the 2.0 level (meaning the dividend is covered twice by earnings) to offer a margin of safety to dividend payments. Cover for the FTSE 100, at 1.6, is much thinner than is ideal. Several 2018 Dog components look even more malnourished.

Focusing on the bigger picture, Link Asset Services (formerly Capita Asset Services) predicts dividend growth on a constant-currency basis of 5% in 2018, half the 10.4% recorded last year.

This coming year, as we move towards a Brexit deal - or not - is going to be a very interesting one.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.