Don't forget AIM stocks when building your ISA

9th April 2018 11:24

by Andrew Hore from interactive investor

Share on

The government's decision to allow AIM shares to be included in individual savings accounts (ISAs) back in August 2013 is a major reason behind the surge in trading volume on AIM.

Trading levels are always affected by the underlying market conditions, but trades rocketed from 7.15 million in 2012 to 11.5 million last year.

The 2017-18 ISA limit is £20,000 and it is the same for the 2018-19 tax year. Remember, you can also transfer existing cash ISAs into stock and shares ISAs and invest the cash in AIM shares.

ISA advantages

The standard tax advantages of investing in an ISA are still there, but there are specific advantages of investing in AIM shares.

One of the most significant is inheritance tax (IHT) relief, also known as business property relief. This has been available for more than four decades and to be eligible the company must be unquoted and the shares owned for at least two years by the date of death before they are free of any inheritance tax charge.

Although AIM shares are quoted, they are deemed for tax purposes to be 'unquoted', because they are not quoted on a recognised stock exchange (such as the London Stock Exchange's Main Market).

Not every AIM company is eligible for IHT relief, though. Companies whose main business is dealing in shares and securities, investment companies taking stakes in other business or those companies that primarily own land or buildings are not eligible.

AIM outperforms

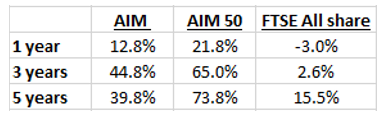

Obviously, investing in anything based on purely the tax advantages is not advisable, but AIM shares have proved to be excellent investments over the past five years. They have offered much better growth than their fully listed peers. Larger AIM companies have done better again and outperformed the whole of AIM.

12 months to 22 March 2018

Source: interactive investor Past performance is not a guide to future performance

This outperformance by the AIM 50 could in part be put down to the demand for potentially more liquid and safer investments to take advantage of the tax perks on AIM.

In the past, the performance of AIM has been patchy, but the maturing of the junior market and the larger companies traded on AIM have helped to offset peaks and troughs related to sectors which can become fashionable and then go out of favour a couple of years later.

There are plenty of AIM shares that pay a dividend and some offer yields of more than 4%. Although, overall yields may tend to be lower than for fully listed companies, this needs to be balanced by the higher growth potential of many of the AIM companies.

AIM opportunities

There is much less analyst coverage of most AIM shares in comparison with the large fully listed shares. This provides opportunities for others to spot undervalued growth opportunities. There are nearly 1,000 companies to choose from so investors need to be able to sort the wheat from the chaff.

Choices will also depend on the level of risk that an investor wants to take on. An attraction of AIM is the ability to invest in newer, growing sectors that have not reached the point where there is much representation on the Main Market. The internet boom and other sector fashions show that investors need to be careful in their choices, though. There can be some winners, but many will be losers when a new sector is just taking off.

There are opportunities to invest in technology companies on AIM which are not available on the Main Market. Software robotics company is an example of this, although it is very highly rated now investors had an opportunity to invest at a much lower share price and in an ISA the gain would have been capital gains tax free.

Video games services provider is another example of a company that AIM can offer investors that the Main Market cannot. The share price of the consolidator of international video games art and translation services businesses has risen by nearly 700% over two years and it offers a small, but growing, dividend.

When seeking a suitable IHT relief-based investment there needs to be a certain mindset. It is no good seeking out short-term opportunities. Well-established companies with good cash flow and offering dividends are ideal for IHT relief. They should have a good and experienced management team and a strong market position, along with good growth prospects - it is no good investing in an established company where the market is declining.

The likes of floorcoverings supplier and patent translation services provider are sought after for IHT portfolios. That is why they are so highly rated and why they stay on AIM even though they are relatively large companies.

It is important to diversify risk by having a portfolio of IHT qualifying AIM shares and not to be frightened to sell an investment if it is the sensible decision to make. Investment in profitable and cash generative companies is still risky just like any share. It may be less risky than an early stage business, but markets change all the time. However, don't get dazzled by the tax benefits. Normal investment rules still apply.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.