Where to invest your ISA contributions

19th April 2018 11:01

by Dzmitry Lipski from interactive investor

Share on

How should your ISA portfolio be positioned in the current environment?

Once you have contributed to an ISA, the next step is to invest that money in order for it to grow. You should use an ISA for longer term investment, at least five years. The longer you stay invested, the more your portfolio can grow through compounding or income reinvestment.

One of the best ways to grow your portfolio over the long term is by investing in a well-diversified portfolio. Investors should consider having exposure to stocks, bonds and alternatives such as property and commodities. The key question is how your portfolio should be positioned in the current environment in order to maximise returns.

Why should I maintain my exposure to UK equities?

Uncertainty around Brexit and heightened political risk has led investors to shun UK equities, creating value opportunities. While Brexit negotiations will remain a headwind, the UK is still competitively priced relative to other equity markets. And, if earnings improve after their poor performance in recent years, those valuations might become even more attractive for investors.

Additionally, the fall in sterling post the Brexit referendum has boosted earnings for internationally-focused companies, providing support for dividends.

ii Rated Funds: and

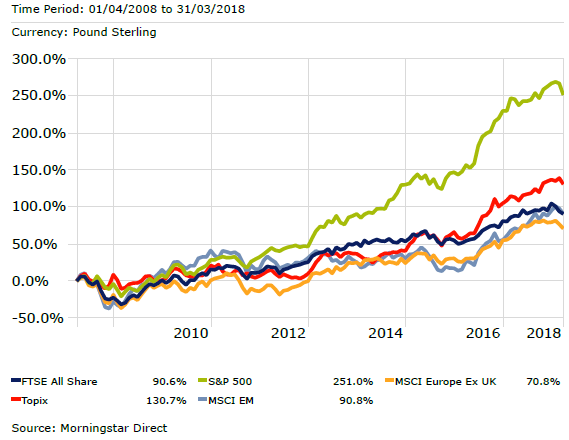

Equity markets performance over 10 years

Past performance is not a guide to future performance

Is it time to sell US equities?

US equities have delivered strong returns since their 2009 lows and valuations have become more expensive. Despite this, the US equity market is hard to ignore for investors, making up almost 60% of the MSCI World Index.

The composition of the US market is particularly interesting for UK investors, since our own stockmarket is heavily concentrated in just three sectors: financial services, energy and materials. Among the largest sectors in the US market, by comparison, are technology, healthcare and consumer discretionary. Therefore, many investors consider the US should be an essential part of any globally diversified portfolio.

As US equity valuations currently look stretched, investors could reduce their allocation and instead look to other regions such as Europe, Japan and emerging markets.

Do Europe, Japan and Emerging Markets offer the best prospects?

While many investors remain cautious about investing in Europe, the outlook is brighter than it has been for some time. European equities have become a sweet spot for investors as the economy continues to recover, with earnings growth coming through.

The European economy is growing faster than UK and US as unemployment is falling and consumption is rising. European equities have significantly underperformed the UK and US equities since financial crisis, and this has created an opportunity to purchase equities that are cheap on a valuations basis.

ii Rated Fund:

Over the years, the Japanese economy has relied heavily on massive monetary easing, central bank balance sheet and asset buying to fight deflation and restart growth with inflation. Due to supportive polices of the government and central bank, the economy has shown signs of recovery and the unemployment rate is at record low levels.

The Bank of Japan's (BOJ) has committed to keeping very accommodative monetary policy, even as central banks in the US and Europe are tightening their policies. This should ultimately lead to a weaker yen and strengthen the attractiveness of Japanese exports further.

In such a favourable environment corporate earnings should continue growing, and valuations still remain attractive relative to other markets.

ii Rated Fund:

Emerging markets have disappointed investors in recent years, with equities there held back by a mix of weak commodity prices, sluggish export growth, and political disruption, but this trend is reversing.

Despite the uncertainty, investors agree that the long-term case for investing in emerging market equities for portfolio diversification and alpha generation remains intact. As the developed world faces an ageing population and low levels of economic growth, emerging markets are growing rapidly and have supportive demographics. They are home to 85% of the world's population and account for almost 60% of global GDP.

The big story in emerging markets is the consumer spending, which is expected to reach $30 trillion annually by 2025 - representing nearly half of all global spending.

ii Rated Fund:

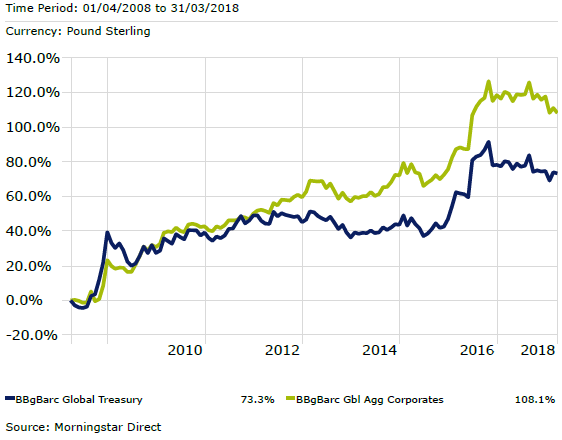

Are my bond holdings at risk?

Bond markets have performed strongly since the financial crisis, mainly boosted by government and central bank policies, such as low interest rates and quantitative easing. While bonds have provided investors with strong capital gains, bond yields have been pushed to historic lows, making them unattractive for income investors.

As we move into an environment where the Bank of England, along with the US Federal Reserve, begin to accelerate monetary tightening in response to rising inflation expectations, investors are concerned that this could cause bond prices to fall and yields to rise. So, now more than ever, investors need to look beyond traditional government bonds and adopt a more flexible approach to address rising interest rates and inflation concerns.

Different bonds react differently to rising interest rates: while short duration exposure to bonds could help investors reduce the impact of rising interest rates and market volatility; investment grade, high-yield and emerging market bonds are considered to be less sensitive to interest rates than government bonds, so their price return is better in a rising rate environment. They usually have higher yields and their total return is also better.

Bonds continue to offer investors the benefits of diversification away from equities, along with stable income and relatively low volatility.

ii Rated Funds: and

Global government and investment grade bonds performance over 10 years

Past performance is not a guide to future performance

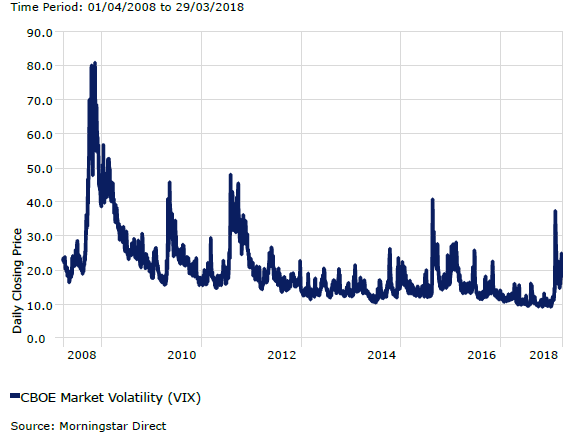

How can I protect my portfolio from volatility?

Markets were complacent in the face of political and economic risks last year. Political instability in Europe and the US, concerns around North Korea and uncertain monetary policy among central banks have all been shrugged off by investors.

With volatility stuck at historically depressed levels (see below chart), investors' expectations are shifting to more sensitive environments given highly stretched market valuations.

Therefore, it makes sense for investors to favour capital preservation, rather than return-seeking mode, by considering absolute return funds which typically aim to limit volatility and deliver positive returns in all market conditions.

ii Rated Fund:

Past performance is not a guide to future performance

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.