Here's how cautious portfolios have done in 2018

3rd May 2018 12:07

by Holly Black from interactive investor

Share on

The UK stockmarket has had a miserable first quarter and is impacting investors' lives.

Our Capital Conserver portfolio is tasked with providing a steady return when times are good and, crucially, protecting capital during the bad times.

The past four months since our last update (January 2018 issue) are best classed as the latter, showing that giving protection is not easy.

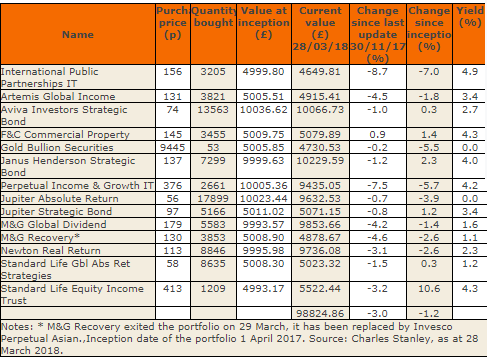

Rob Morgan, investment analyst at Charles Stanley, who is running the portfolio, says: "These past few months have been a perfect storm, where everything that could go wrong for this portfolio has gone wrong. That being the case, I'm pleased we are only down 1.2% since inception at the start of last April."

It's been a year since our Purposeful Portfolios were launched and they have faced a number of challenges; geopolitical uncertainty, violent swings in sentiment and the first UK interest rate rise in a decade.

Just one of the Capital Conserver holdings is in the black since our last update in November -, up 0.9%. Moreover, it is one of six holdings showing a positive return since the portfolio launched.

A sell-off in the bond market has posed a particular problem for cautiously positioned portfolios.

As yields have risen, prices have fallen, which has hit returns. Strategic bond funds should, in theory, provide the flexibility needed to navigate a rising interest rate environment. Morgan is pleased with the performance of , up 2.3% since inception, with a healthy yield of 4%.

Widest discount in years

Rising bond yields have had a knock-on effect on other areas, too - investors are less willing to take on risk for income when they can get it from perceived safer assets, as can be seen in the performance of our infrastructure investment trust International Public Partnerships.

Infrastructure focused investments have been hard-hit, despite the asset class being viewed as a reliable holding across the market cycle due to its high barriers to entry and pricing power.

, for example, is down 8.7% over the past four months. In addition, the trust has swung from a 17% premium to a 3% discount - its widest since the financial crisis.

The high-profile collapse of construction company Carillion cast a shadow over the infrastructure industry, while speculation about what a potential Labour government would mean for the sector has further harmed sentiment.

But Morgan is confident about the future prospects of the trust.

"This isn't a niche investment; it is a £2 billion trust involved in some of the biggest infrastructure projects in the UK, which are critical to the economy, so it's a good investment proposition. I'm hanging in there."

At its widest discount in a decade, now could be a buying opportunity, but Morgan is holding off: "This is the danger you have with investment trusts - you have that extra layer of uncertainty about the discount or premium."

Defensive funds disappoint

Now should be a time when absolute return strategies come into their own - they are designed to deliver a positive return, irrespective of the performance of the stockmarket or wider economy.

Morgan admits to being sceptical, but says that "it's important to have things that are supposed to go up when others go down".

But has proved a particular disappointment. Manager and head of strategy James Clunie holds some contrarian positions, using his shorting abilities to bet against popular technology stocks, such as .

These bets are costly to make and are yet to come off, evidenced by the fund being down 3.9% over the past year. Morgan will be watching the holding over the coming months.

is another which is yet to prove itself. Morgan says: "In many ways, the fund has the same strategy as this portfolio, and it demonstrates in a single holding the difficulties I have had: currency and gold haven't worked as protection, bonds haven't helped, nor have blue-chips."

Down 3.1% since the last update, the fund remains as we wait to see how the next quarter of the year plays out.

Overall, the portfolio is marginally in the red over the past year. That could have been worse were it not for the performance of the .

It's had a difficult few months, down 3.2%, but has delivered a return of 10.6% since inception. By far the strongest performer of the group, it has been boosted by exposure to small - and mid-cap UK stocks, with more than half the portfolio in FTSE 250 and small cap firms, and 10% in Alternative Investment Market (AIM) companies.

Cautious investment portfolios tend to be UK-centric as they avoid racy emerging markets and developing regions.

This too has hurt the portfolio as the domestic stockmarket remains out of favour with international investors.

In addition, the pound marching higher against most global currencies has impacted on the blue-chip companies, as it dilutes their overseas earnings.

That has hurt holdings such as - managed by Mark Barnett - which is down 7.5% since the last update.

Morgan says: "Barnett is a contrarian so has money in unloved areas. I am confident it's going to perform in the long term."

has been disappointing since the outset and Morgan has decided to act. The fund has been ejected from the portfolio in favour of overseas exposure, Morgan backing the instead.

It's a racier choice for a conservative portfolio, but will account for just 5% of assets and will diversify the investments away from the UK, with holdings in South Korea, Hong Kong and Taiwan, including technology giant Samsung and Chinese internet company .

Morgan adds: "This fund is well-rounded with good growth. Share prices are not too expensive, so the time is right to invest." The first year has proved a testing period, but Morgan is confident his 'combination of resilient assets' will deliver.

Past performance is not a guide to future performance

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.