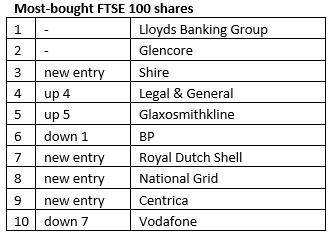

Most popular FTSE 100, AIM and overseas shares in April 2018

9th May 2018 11:03

by Lee Wild from interactive investor

Share on

April was one of the best months for equity markets in the past decade, but which blue chip, AIM and international shares you were buying in April?

Here are the most popular shares among interactive investor clients last month, with comment from our in-house experts.

Source: interactive investor

Richard Hunter, head of markets at interactive investor:

As the new tax year began, a combination of portfolio positioning and a strong overall performance by the in April meant the most bought stocks by clients on the interactive investor platform mirrored market themes.

Commodities, including oil, had a good showing during the month for different reasons, with the likes of , and featuring in the top 10. By association, and were new entrants, both having the additional bonus of punchy dividend yields (5.3% and 7.7% respectively).

Stock specifically, retained the top spot in the midst of reporting impressive first quarter earnings, while was a new entry at number three -strong quarterly earnings and what looks like a knockout bid from of Japan, a deal which values Shire at £46 billion, saw the shares rise 9% over the month. As a read across, also rose five places in the table to come in fifth.

Another stock climbing the table to number four was , which also benefited from a good April performance in the share price (up 6%) and an attractive dividend yield of 5.6%.

Source: interactive investor

Lee Wild, head of equity strategy at interactive investor:

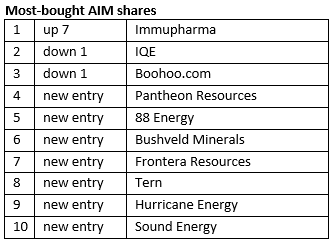

It was all change on AIM last month, with seven new entries among the 10 most popular stocks and one small-cap making up seven places to take top spot.

Investors took a spectacular 88% plunge at drug developer as their cue to pick up stock at bargain levels. Trading at 147p ahead of phase III results for its Lupus drug Lupuzor, the shares swapped hands for as little as 18p following a disappointing outcome.

While Lupuzor did better than the placebo, it wasn't by enough to meet the trial's primary end point. It's not over for Immupharma though, and investors are now betting that ongoing commercial talks will lead to a lucrative tie-up with a big drug company.

Old favourites and both dropped a place last month but stayed ahead of a chasing pack dominated by resource plays. After losing two-thirds of its value in April, has attracted attention from investors backing an experienced team to overcome problems at its Texas well.

A surge in oil prices is a boon for the energy sector, although long dated crude prices at less than $60 a barrel are not yet reflecting short-term optimism. When they do, the potential upside for small-cap oil companies could be significant.

Source: interactive investor

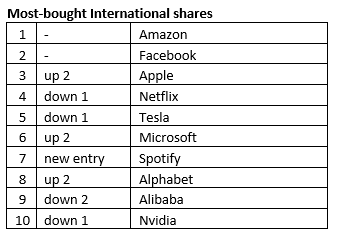

There are several good reasons for buying overseas shares, not least the access they give to the world's largest tech companies, which are absent on the London exchange. It's why the 10 most popular international shares on the interactive investor platform in April were all huge US tech firms.

Few companies are able to compete with , and it's a combination of this dominant position and potential for expansion across industries that makes the stock so popular. A data scandal and political grilling for founder Mark Zuckerberg hammered stock in March, but investors decided a nine-month low was too good to miss, and the shares are up over 15% since.

There was plenty of interest in music streaming giant Spotify which listed in New York at the beginning of March. It's IPO was unconventional in that it involved only existing shares, not new ones, but they still rallied from a post-float low of $135 to a recent peak at $171. They've just dropped back despite decent maiden quarterly results because investors had expected even more from the loss-making company, particularly around the number of paid subscribers.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.