Dividend alert: Three high-yielding bond proxies flash red

21st May 2018 10:55

by Kyle Caldwell from interactive investor

Share on

Bond proxy stocks, those that on the surface offer a safe and predicable income, have thrived under the decade-long loose monetary policy environment. But with expectations of an interest rate rise being pencilled in for August, some investors have moved to cash in their chips.

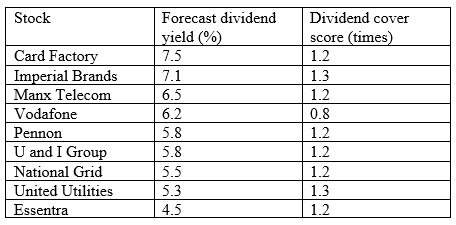

Our dividend danger zone screen, which uses a range of filters to pick potential yield traps, casts doubt over three stocks in the utilities sector, which tends to be viewed by investors as classic bond proxy territory. Water company share prices in particular have come under pressure of late, with some investors fretting that they may be nationalised if Jeremy Corbyn becomes prime minister.

Water businesses and are both offering dividend yields above 5%, as is power company , but all have seen their earnings downgraded by analysts. Moreover, the three businesses' dividend cover scores are far away from being deemed comfortable.

Stock in focus

In the case of United Utilities, which has seen its share price fall by 26% over the past year, a 5.3% dividend yield looks attractive on paper, because its balance sheet contains cheap debt that has been financed for 30 or more years. According to Simon McGarry of Canaccord Genuity Wealth Management, this "should boost returns on equities for many years."

But he adds that the next regulatory period will be tougher for water companies; in addition he points out that "without achieving cost savings and efficiencies from its operations, United Utilities will have a hard time earning more than its cost of capital."

Last month industry regulator Ofwat told water companies to put the customer before shareholders' interests. Rachel Fletcher, Ofwat's chief executive, said: "We are making moves on three fronts to get a better outcome for customers.

"First, any company with high levels of debt which boosts their returns will be expected to share gains with customers. Second, companies need to ensure dividend policies are transparent and make sure they've met their obligations to customers before making dividend payments. And third, we want to see that water company executives are rewarded for delivering for customers, not just shareholders."

Other concerns

Our dividend danger zone screen started six months ago and the same names keep on cropping up as potential value traps.

, which boasts the highest forecast dividend yield (7.5%) out of the nine shares in the dividend danger zone screen, has retained its place on the list each month since December. In January the company suffered its second profit warning in four months.

has featured on the list since January, a surprising entrant given that the firm has grown its dividend for the past 15 years. In addition, its management team remains committed to growing the dividend by 10% per year.

, which manufactures plastic products, has appeared previously, as has , which in late 2017 lost roughly a fifth of its post-pay revenues.

The two new entrants this month are and , a property developer.

Source: interactive investor Past performance is not a guide to future performance

The mechanics behind the screen

We apply the following filters: a market cap of over £200 million, a dividend yield of 4% (higher than the average) and a dividend cover score of below 1.4 times.

Two other filters were also applied: the first filtered out companies that appear in a financially sound position to pay off their debts, while the second excluded firms with positive earnings per share momentum for the next three months.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.